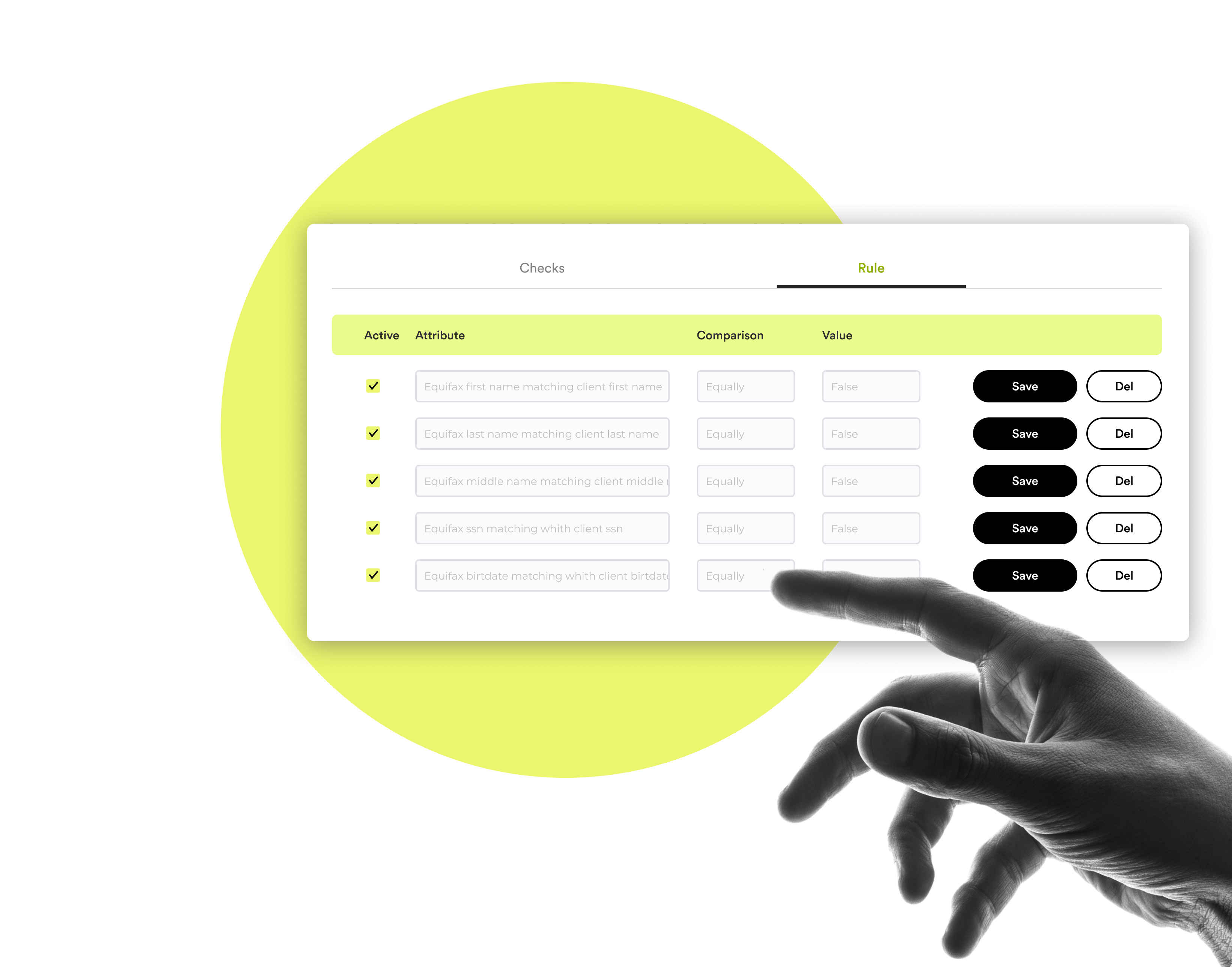

End-to-end no-code platform to extend your digital lending process

Neofin is the first no-code loan automation platform that offers mixed pricing combining subscription and pay-as-you-go models.

spent to build, tune and tweak our no-code lending automation platform

seamlessly issued through Neofin every day

total experience in the banking and fintech industry in the core team

continents of operation

Neofin is proud to win a position in the top 10 and become a part of exclusive Equifax Product Studio

Neofin is an awardee of the Fintech & E-commerce Linking Days Awards in Poland

Neofin is partnering with Mastercard in MENA to drive the card-enabled lending automation in the region

Neofin is a recognized innovator in the US Dept of State’s Global Innovation through Science and Technology (GIST) initiative

Cyber Security and Compliance