No-code Lending Software

Cover all your needs by adopting the power of no-code software to launch any new loan products in a matter of 1 hour. Automate all the stages from the first touch with the application through the scoring and loan servicing.

Take advantage of the no-code approach

Existing smaller solutions specialize in certain lending types (auto, mortgage) and only partially cover the borrower’s journey;

Launch with complex legacy systems requires integrators or even several vendors;

Special employee education is needed;

Existing enterprise solutions take 1-8 months to launch.

End-to-end modular no-code software with the fully automated flow for your applications with the precise KYC, scoring modules, and decision engine;

No need for specific expertise or involvement of IT specialists;

No employee training is required since the instance is set up from an intuitive control panel;

Agile approach with an ability to test ideas and launch new products within 1 day.

End-to-end no-code platform to extend your digital lending process

Neofin is the first no-code loan automation platform that offers mixed pricing combining subscription and pay-as-you-go models.

Benefits of Neofin no-code platform:

Fully automated onboarding process

Ready to go modules and interfaces

Affordable for startups and new embedded finance projects

We are trusted by

One platform to serve your business

No matter what type of loan you provide, Neofin covers you from inquiry to credit scoring, issuing, and verification.

Testimonials

Neofin has made our life so much easier. We have only registered a company and got the first license. We went live much faster than planned and became profitable on the 6th month of operation!

As for Neofin, their modular system is just perfect for such solutions. With them, we created a revolutionary product in the region which was live in a month (including all our internal work). And it is not just MVP but a fully working credit line.

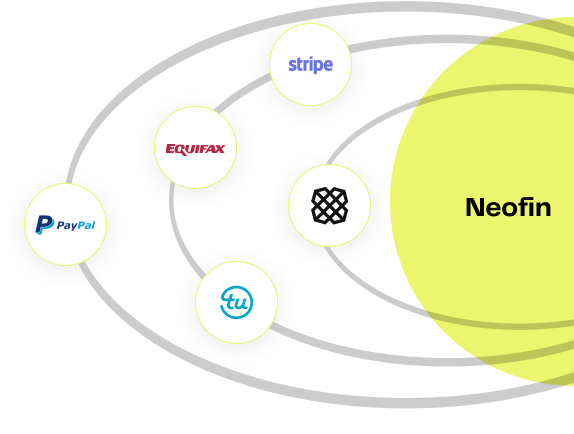

Integrations to boost your growth

We’ve partnered with third-party technology, scoring, servicing, and reporting solutions to make your lending process easy to use and smooth.

spent to build, tune and tweak our no-code lending automation platform

seamlessly issued through Neofin every day

total experience in the banking and fintech industry in the core team

continents of operation

Neofin is proud to win a position in the top 10 and become a part of exclusive Equifax Product Studio

Neofin is an awardee of the Fintech & E-commerce Linking Days Awards in Poland

Neofin is partnering with Mastercard in MENA to drive the card-enabled lending automation in the region

Neofin is a recognized innovator in the US Dept of State’s Global Innovation through Science and Technology (GIST) initiative

Cyber Security and Compliance