BNPL Software

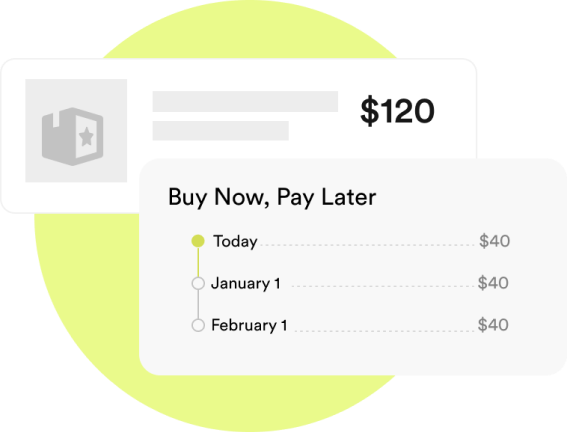

Neofin offers a no-code BNPL software for financial institutions easily integrate with various merchants and seamlessly finance “buy now - pay later” purchases of the end users.

Our BNPL is designed to:

Pre-purchase

Point of sale

Post-purchase debit

Credit cards with BNPL

Online checkout & API methods

Decrease the Client Acquisition Cost compared to traditional acquisition channels

Seamless and user-friendly registration in 5 steps, requiring only the date of birth and phone number of the client

Get new warm leads, ready to buy the product: right here, right now!

Grow the clientele thanks to integrating with merchants of various types (car dealerships, healthcare services, online stores)

Easy to add to your existing lending or payment platform

Card enabled BNPL for offline checkout

Out-of-the-box integration with virtual and physical card issuing providers and systems

Provide all necessary AML & KYC checks for the card issuer

Engage split before or after the transaction at checkout

Automatically transfer data to Core Banking System

Mass sendings and pre-collection reminders

We are trusted by

Testimonials

Neofin has made our life so much easier. We have only registered a company and got the first license. We went live much faster than planned and became profitable on the 6th month of operation!

As for Neofin, their modular system is just perfect for such solutions. With them, we created a revolutionary product in the region which was live in a month (including all our internal work). And it is not just MVP but a fully working credit line.

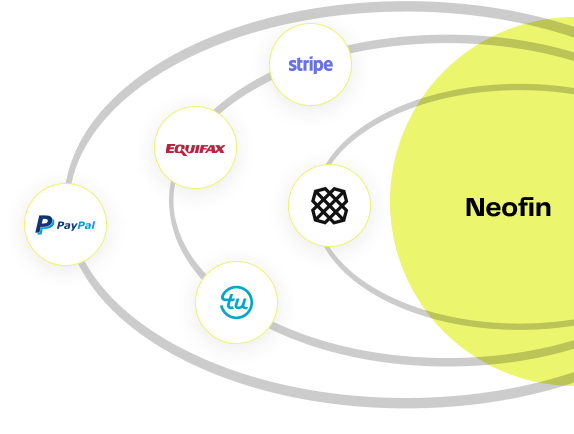

Our integrations

Our BNPL module has built-in integrations with Plaid, Experian, Equifax, and other data sources and reporting services.

Cyber Security and Compliance