Explain the following two options highlighting their pros and cons.

(Company offers a ready-made model and calculates the main indicators for the profitability and default of the loan portfolio. This solution is a closed source development; changes require contact with the software developers. Development and training of the employees take from 3 months)

(Constructor of scoring models or scoring rules, in which the product owner can set up a scorecard on his own, but the product owner must have the competence of a risk analyst or hire a good risk analyst)

Share our Youtube video, explain to readers how our decision engine works and offer readers to start a free trial.

One of the most consequential and responsible lending business activities is credit decisioning. In addition, the procedure involves the collection and analysis of large amounts of information, which increases the risk of human error. And since the stakes are high, many banks are opting to automate processes, removing humans from the loan equation and replacing them with powerful credit decisioning software.

What is more, intelligent programs are capable of processing large amounts of data in minutes without compromising quality. And this, in turn, reduces waiting time, which leads to higher conversion rates, higher satisfaction, and increased business value.

We will explore the latest software implemented by banks and credit unions to make instant credit decisions, and choose the best one. But first, let's look at how the most important decisions in the loan business are made.

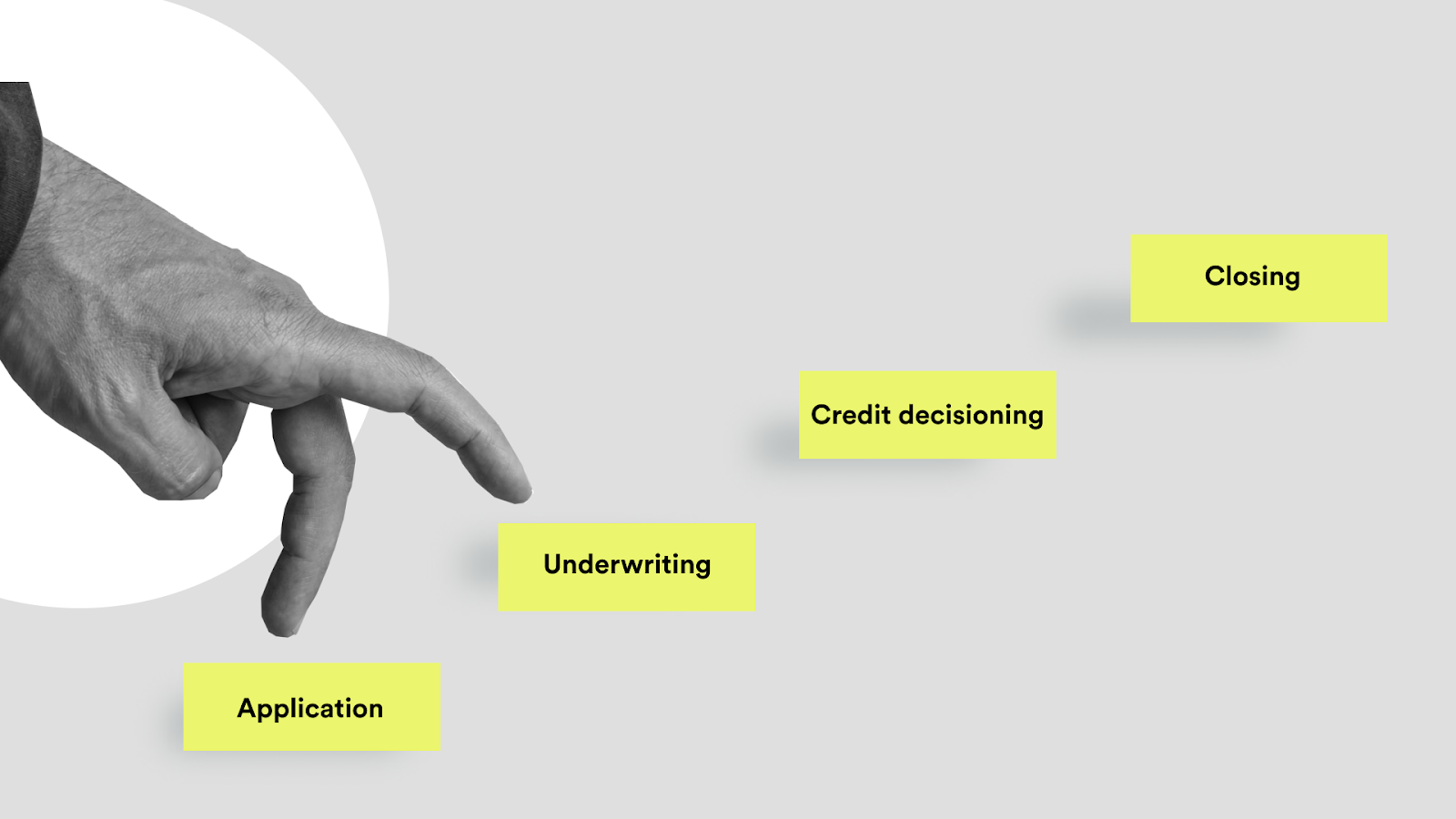

The details of the decision-making process may differ from enterprise to enterprise, but in general, it usually consists of four main stages.

At the first stage, an application for a loan is filled out, which is also accompanied by the necessary documents.

An application is one of the main documents on the basis of which, in the course of making a decision on a loan, all final calculations are made regarding the loan amount, monthly payment amounts, loan repayment periods, and the like. It is these calculations that are checked and evaluated in terms of the risks that the bank assumes in the event of a positive decision on the loan.

If a bank employee reveals intentional errors in the application, a desire to overestimate an applicant’s income or unwillingness to document them, the bank has the right to refuse to issue a loan to the applicant for the reasons listed.

This stage is a set of measures aimed at analyzing and verifying the information received from the applicant in order to assess the risks that the bank assumes when providing a loan.

An underwriting expert determines the likelihood of a potential borrower repaying the loan provided in full and on time, based on the information contained in the application, as well as data obtained from reliable independent sources.

After the procedure for assessing the probability of repayment of the loan, the underwriting expert prepares for the credit committee of the bank a report on the results of underwriting, which contains draft decisions related to a particular borrower:

• provide a loan to the client, indicating the loan amount, terms and conditions of repayment;

• refuse a loan, indicating the grounds for refusal;

• conduct an additional analysis of information about the borrower, with a possible modification of the initial loan terms.

In the event of a positive decision, the bank informs the borrower about the procedure and terms for concluding a loan transaction, including the procedure for processing a loan and a contract.

The borrower is informed of the final details of the loan, i.e. loan amount, terms and conditions of its repayment.

The legal service of the bank controls the correctness of the conclusion of all agreements, as well as the procedure for their execution, provided for by law and instructions of the bank.

As previously mentioned, automation generally has a positive effect on workflow and conversion rates by increasing customer satisfaction. With regard to credit decisions, excellent results are achieved due to the following advantages of process automation:

Speed & Accuracy. One of the most valuable benefits is the speed of processing large streams of loan applications in real time, including the verification of large amounts of data from various sources during the underwriting process. Moreover, the speed of data processing in no way affects the quality. Conversely, automation has been shown to provide a high level of predictive power (accuracy), in other words, an acceptable level of misclassified borrowers.

Objectivity & Consistency. Staff may interpret a bank's credit policy in different ways and may not even consider important risk factors when making credit decisions. At the same time, the use of special credit decision modules helps to identify objective patterns between various factors and minimize the influence of the subjective human factor on decision-making.

Adaptability & Agility. Automation makes it possible to take into account changes in the external and internal environment of a credit institution, including taking into account regulatory acts of supervisory authorities. Making timely adjustments to, for example, risk weights and final thresholds will allow more informed and accurate loan decisions to be made. At the same time, the adjustment of the credit decisioning engine should not require the involvement of qualified specialists to adapt it to the new data structure.

There are two main types of software that FIs, credit unions and banks use in making credit decisions. Each company should decide, based on its goals and available resources, which option is best for its business.

This option foresees using the software that has its own decision engine module which deals with taking credit decisions.

The market offers 2 types of decision engines at the moment:

Format 1. Pre-set automated scoring

The category features solutions that offer a ready model and calculate the overall indicators of the profitability and default rate of the credit portfolio.

With the help of AI decision-making engines from various sources, data about a potential borrower is collected and processed within moments, including the analysis of behavioral data collected from social networks or online purchases. The data is compared with the company's risk calculation criteria and a decision is made.

Such solutions usually don’t offer access to their codebase. Any changes of customizations would require contacting the developers of the solution.

Customisation, development and learning curve for the new model usually takes 3 months+.

Format 2. Scoring model constructor

In such cases, the software platform provides a constructor. Owner of the lending business can set up the score card fully on their side using the constructor. In order to do this, the representative of the lending business must have a risk management expertise or a strong risk analysts team.

Unlike the previous fully automated credit decisioning engine, this option is a symbiosis of an open source program and dedicated lending experts. This type of software is a constructor of scoring models or scoring rules, in which the product owner can independently set up a scorecard if he or she has the competence of a risk analyst or hire a good risk analyst for this task. The advantage of this automation model is its flexibility. Various business rules can be created, supplemented and modified with a simple connection to any type of workflow.

This option is suitable for those who are not yet ready to move to full automation and want human participation or management. However, it should be remembered that the more a person is involved in the process, the greater the likelihood of human error.

Some are concerned that with the automation of credit decision making, they will lose control over their lending business. However, this is not the case. Neofin decision engine and scoring is not intended to replace your company's lending process, but to make it faster and more efficient.

Check out the video to see how you can effectively apply your own risk model based on data from external sources and application parameters using our decision engine.

To experience the benefits of loan decisioning software in-action, start a free trial or contact us for more details.