“At Neofin, we recognize that the Small-Dollar Loan Rule (SDLR) introduced by the Consumer Financial Protection Bureau (CFPB), is quickly becoming one of the hottest topics in the lending industry, especially with the most recent shifts in regulatory requirements. As these changes continue to evolve, lenders must be prepared to adapt swiftly to stay compliant.

To help our partners navigate these challenges, we have decided to launch a series of informative content focused on small-dollar loan regulations. Our aim is to equip lenders with the tools and knowledge they need to remain compliant and competitive.

In this article, we will break down the core elements of the SDLR, explain its impact on lenders, and offer insights into how to stay compliant with the new rules.” — by Svitlanka Sergiichuk, CEO at Neofin

The Small-Dollar Lending Rule (SDLR) addresses the growing concern over payday loans and other high-interest short-term loans. Historically, these loans have been associated with high fees and aggressive repayment practices. The SDLR aims to protect borrowers by limiting some of the harmful practices seen in the industry, such as excessive fee charges from failed payment attempts.

The main goals of SDLR are to improve transparency in lending and to give borrowers a better chance to repay their loans without falling deeper into debt. This rule focuses on improving the way loans are collected and ensuring that lenders are transparent about the terms and conditions of these loans.

1. Two-Strike Limit on Payment Attempts

Lenders are prohibited from attempting to withdraw funds from a borrower’s bank account more than twice in a 30-day period. If two payment attempts fail due to insufficient funds, the lender must stop attempting withdrawals.

2. Notice Requirements

Lenders must send an advance notice before attempting a payment withdrawal and a consumer rights notice if two withdrawal attempts fail. These notices ensure borrowers are aware of the upcoming payment attempts and their rights if the payment fails.

3. Extended Repayment Terms

The SDLR includes provisions requiring lenders to offer longer repayment periods for borrowers facing difficulty in meeting their obligations.

4. Exemptions for Small Lenders

Some small-volume lenders and depository institutions are exempt from the SDLR if they meet specific criteria, such as issuing fewer than 2,500 loans per year.

The SDLR will require lenders to adjust several aspects of their operations:

Compliance and Operational Changes: Lenders will need to implement new systems to track failed payment attempts, manage notifications, and ensure compliance with the two-strike rule. This may require upgrades to internal processes and software tools to facilitate compliance.

Increased Costs: The compliance burden could result in additional operational costs for lenders, particularly for smaller businesses that may not have the infrastructure to manage these changes efficiently.

Revenue Impact: For many payday lenders, revenue often relies on multiple failed payment attempts. With the new limitations, lenders may experience reduced income from fees and penalties associated with non-payment.

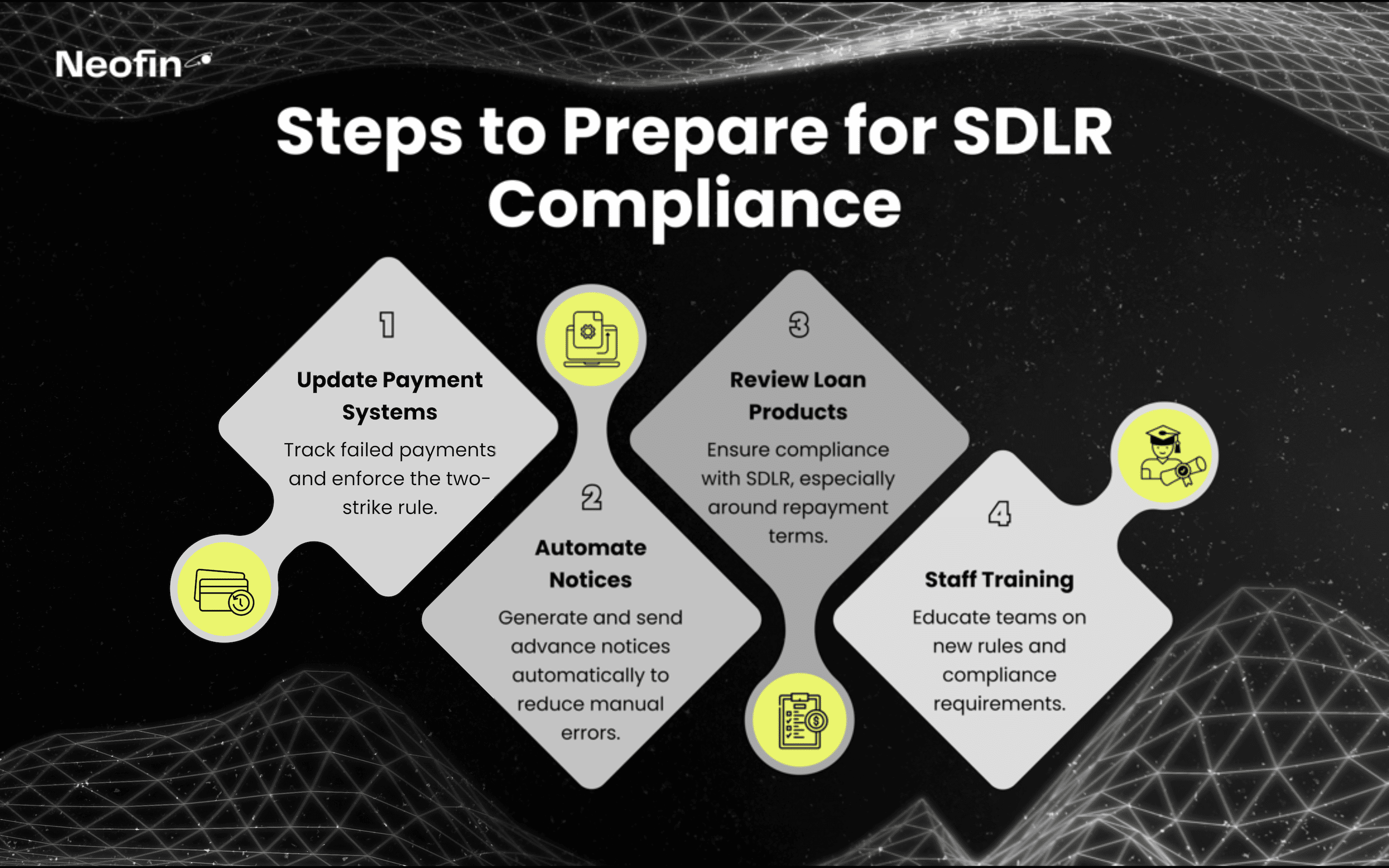

Lenders should take proactive steps to ensure they are prepared for the upcoming SDLR implementation:

1. Update Payment Collection Systems

Lenders will need to modify their payment collection systems to comply with the two-strike rule. This includes tracking failed payment attempts and halting further attempts once the limit is reached.

2. Automate Notice Generation

Automating the generation of advance notices and consumer rights notices will help ensure compliance and streamline the process, reducing the risk of manual errors.

3. Review Loan Products

Lenders should evaluate their loan products to ensure they comply with SDLR guidelines, especially concerning repayment terms and loan structures.

4. Staff Training

Training staff on the new regulations and compliance requirements will be crucial. This includes understanding the rules for notification and payment limits, as well as the broader implications for borrower relations.

Despite the benefits of these regulatory changes, lenders may face several challenges:

Adapting to New Processes

The transition to SDLR-compliant operations may require significant time and resources, particularly for smaller lenders that may lack the necessary infrastructure.

Potential Loss of Revenue

Lenders may see a reduction in revenue from fees, especially those dependent on late payment fees and penalties. This can affect the profitability of their loan products.

Uncertainty About Enforcement.

While SDLR regulations came into effect in March 2025, enforcement will not be prioritized initially. This could leave lenders unsure about when or how strictly the rules will be enforced, leading to a period of uncertainty.

In a significant update, the Consumer Financial Protection Bureau (CFPB) has announced that, starting March 30, 2025, it will not prioritize enforcement actions or penalties related to the Payment Withdrawal and Payment Disclosure provisions of the Small-Dollar Loan Rule (SDLR). The Bureau has decided to focus its resources on other pressing issues, particularly those affecting servicemembers, veterans, and small businesses.

While this relief provides some temporary reprieve for small-dollar lenders, it's important to note that the CFPB is also considering a future notice of proposed rulemaking to narrow the scope of the rule. Lenders should stay informed about these potential changes, as they could alter the implementation and enforcement of the SDLR in the coming years.

This update gives lenders more time to adjust to the SDLR without immediate regulatory pressure, but it also emphasizes the need for vigilance and flexibility as future regulatory changes may impact the lending landscape.

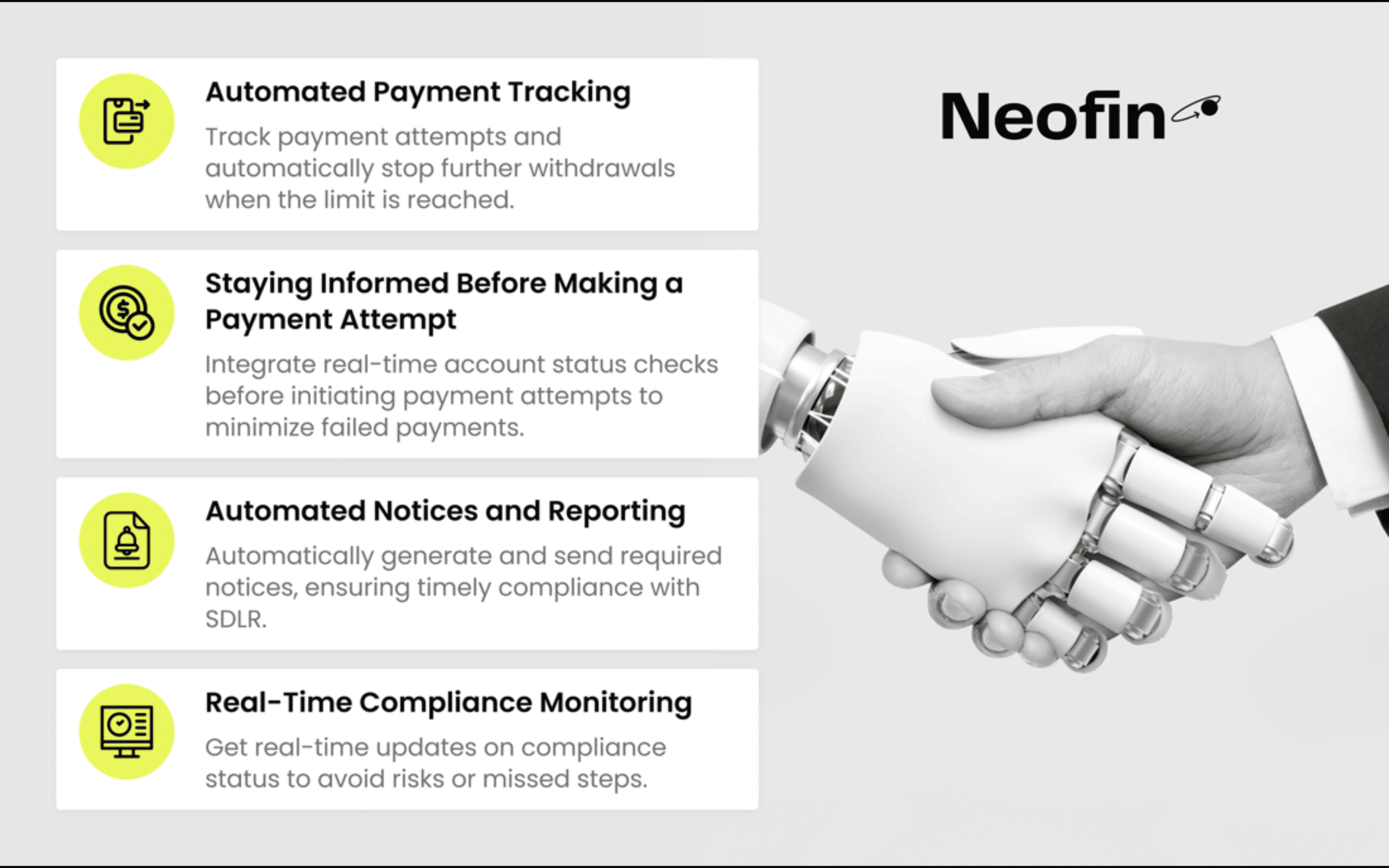

The complexity of these regulations makes automation a key tool for lenders aiming to maintain compliance with SDLR. Neofin’s platform offers several ways to streamline and automate key compliance processes:

Automated Payment Tracking.

Neofin’s system tracks payment attempts and automatically stops further withdrawal attempts once the limit is reached, ensuring full compliance with the two-strike rule.

Staying Informed Before Making a Payment Attempt

Neofin is integrated with multiple open banking solutions that allow lenders to track a consumer's account status in real-time before initiating a payment attempt. This integration ensures that lenders can check the availability of funds, minimizing the risk of failed payments and ensuring that payment attempts are made only when sufficient funds are present.

Automated Notices and Reporting.

The platform generates and sends the required advance payment notices and consumer rights notifications automatically, reducing the administrative burden and ensuring that all notices are sent on time.

Real-Time Compliance Monitoring.

Neofin’s software provides real-time updates on compliance status, helping lenders stay informed about potential risks or missed compliance steps.

The Small-Dollar Loan Rule (SDLR) represents a significant shift in how lenders must manage small-dollar loans. With its emphasis on transparency, borrower protection, and the restriction of harmful practices, it will likely lead to better lending practices and a more sustainable loan market. However, the regulatory changes bring new challenges for lenders, particularly regarding compliance and operational adjustments.

To ensure compliance and minimize disruption, lenders should leverage automation tools like Neofin’s platform. By automating payment tracking, generating required notifications, and ensuring seamless compliance, lenders can reduce the risk of non-compliance and focus on maintaining positive relationships with borrowers.

Ready to streamline your lending operations? Schedule a demo with Neofin to see how our platform can help you stay compliant and operationally efficient under the new SDLR rules.