The introduction of digital no-code technologies has become one of the leading trends in the activities of various economic entities, including such conservative sectors as financial institutions and particularly commercial banks.

The preference for digital banking is wide-ranging. According to Forrester, 69% of Spaniards, 77% of Canadians, and 71% of North American consumers intend to use online banking at least once a month. According to Insider Intelligence, 89% of all US bank customers, and considering only millennials 97%, are digitally tuned.

On the other hand, some are concerned about the risks and resource costs associated with moving to workflow automation. This means that established financial institutions need to develop their business digitally in order to remain competitive, and, at the same time, leverage the strengths, such as reliability, and a large volume of assets, that startups do not have yet.

Let us consider the role of no-coding tech solutions in the digital transformation of the banking sector.

The lockdown has resulted in a more distributed work environment, requiring a reshaping of the workforce, digitization, and increased automation. Now, it has become obvious that there will not be a 100% return to the offices of employees who have tried to work from home. Employers have also appreciated the benefits of remote work for a certain layer of the workforce.

A dispersed workforce requires a set of effective tools for staff interaction in a digital environment. A unified no-code platform will allow managers to efficiently manage the workflow and quickly provide support to employees working remotely.

Many financial institutions use certain software and hardware that have served their business faithfully for many years. However, with the advent of new trends and the growth of business needs, it is critical to find and implement new innovative solutions that will become worthy successors to outdated systems. And in this case, the main thing is not to trade bad for worse.

With the use of no-code technology, banks and financial organizations can not only upgrade their legacy systems but also create new enterprise-level applications with all required financial third-party integrations. And all this is possible without the need to involve software developers, who would be indispensable in the case of creating apps from scratch.

According to Forrester, nearly 90% of online businesses are already investing in personalization and seeing its benefits. Out-of-the-box approach not only increases customer loyalty but also increases profits.

Liveclicker claims that businesses using advanced personalization make $20 in profits for every dollar spent. It's a 20:1 ROI. So if you're still in the top 10% that aren't investing in it yet, now is the time to start. And the no-code or low-code platform customizable according to customer preferences and business needs will assist with this.

In the face of fierce competition, growing business needs, and the emergence of new regulatory requirements, it is essential for banks to be able to respond quickly. This is especially true for financial services such as credit granting. Manual processing of loans is always high labor costs and accumulation of files, which hinders the timely closing of loans.

On the other hand, it can take years to develop and launch a new product to automate the lending process. This refers to development from scratch, but platforms like Neofin offer no coding solutions for the launching of new lending products within 1 hour.

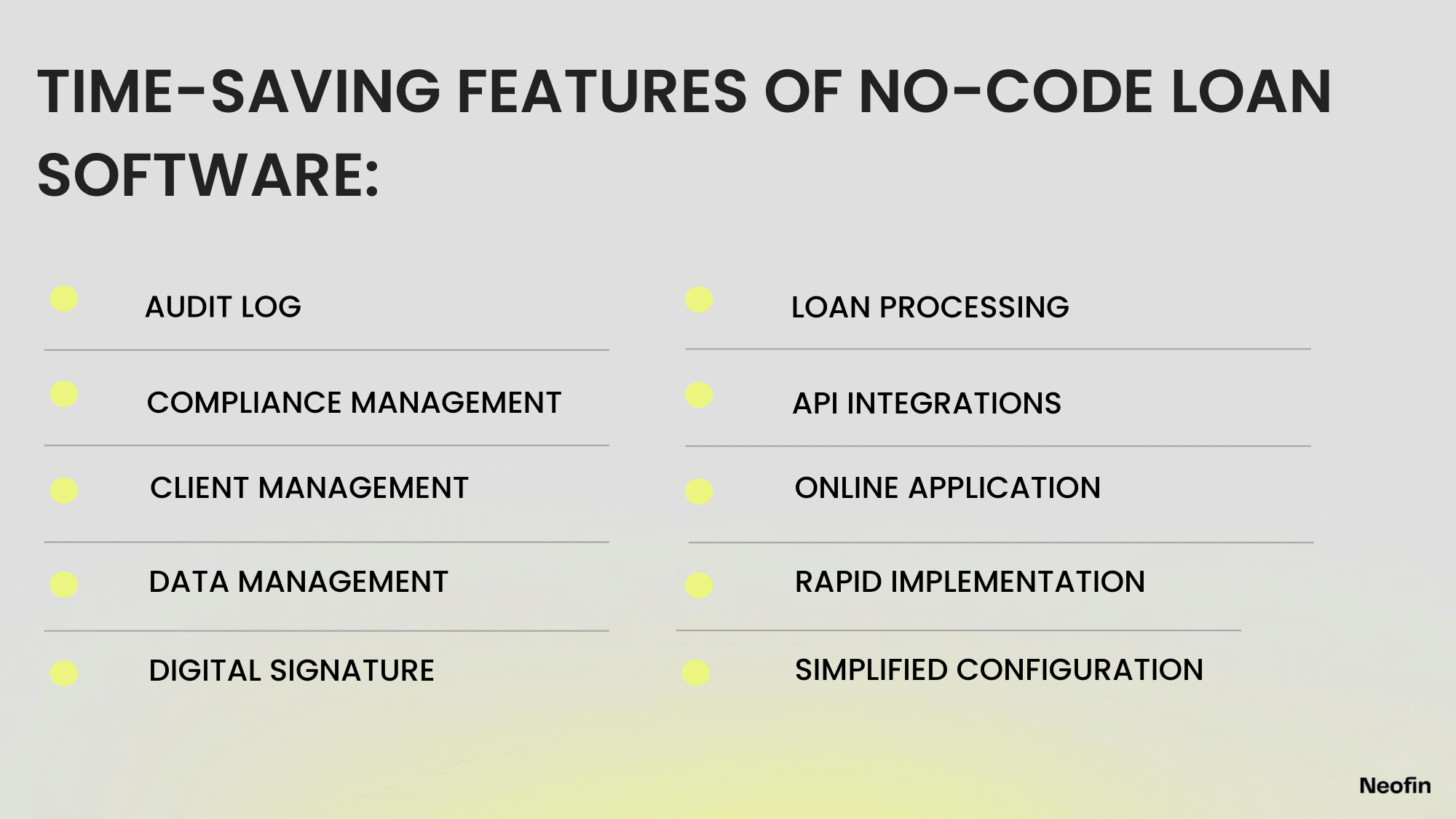

Automated loan processing through simple no-code apps has the following benefits:

Reduced loan application processing time and workflow optimization;

Increased customer satisfaction;

Simplified management and tracing of documents;

Improved data entry accuracy;

Efficient regulatory compliance.

There are many options for using no-code software in banking. Below are some of the most beneficial use cases.

As demand for lending grows, banks must resort to workflow improvements, including advanced automation and digitalization, to cope with the load.

No-code banking software will speed up and simplify the entire loan origination process, from checking the credit history of potential borrowers to ensuring that all obligations of the parties are met. And the integration of digital tools with various systems and departments reduces the time from applying to obtaining a loan, making the client satisfied.

Advanced no-code lending platforms have a competitive advantage over traditional stand-alone platforms that do not share common technology and cannot communicate with each other. Due to a set of high-tech fintech solutions integrated into a common single ecosystem, lending management has become much easier and more efficient.

Deloitte reported that banks are losing up to 40% of their customers precisely because of problems with digital onboarding experiences. Banks cannot provide end-to-end digital service, and customers who want to open a bank account have to visit the office to sign the final paperwork.

A number of fintech companies offer no-code digital onboarding platforms that significantly speed up and simplify the onboarding procedure that can be done from any device with a camera and Internet access. AML/KYC-compliant platforms have a set of AI-powered biometric tools for document and face recognition, as well as data verification algorithms.

Investing in digital onboarding software will reduce costs, increase efficiency and increase conversion rates.

AML and KYC no-code software helps financial institutions manage the identity verification process by allowing them to automatically identify high-risk customers. Automating the AML investigation process reduces processing time by more than 60%.

Various algorithms ensure that the KYC database, AML, and other information sources are constantly linked. An effective no-code solution integrated into one system prevents banks from becoming involved in financial crimes and helps to counteract them by detecting and reporting them.

In a nutshell, decisioning software is a fully customizable platform with automated decision-making based on rules and criteria, such as bankruptcy, insolvency and AML checks, credit scores, and more set by the owner.

Industries dealing with a large number of applications that need to be approved or denied can benefit greatly from such a solution. The credit decisioning process, which used to take weeks, now takes up to 15 minutes thanks to the power of automation.

Due to the current economic situation, deferred payment services have become very popular. The no-code BNPL software is developed very quickly and is easy to use.

Therefore, customers will be satisfied with simple online purchases of goods and payments in installments, while financial institutions will be able to track their payments and control their delays.

No-code BNPL platforms are flexible and easily customizable in accordance with the necessary conditions for granting a loan.

There are many examples of financial institutions successfully using no-code solutions. One of the latest stories belongs to Unex Bank, which launched the first banking lending product. Unex wanted to be the first bank to enter the market with a product that competed with payday and emergency lending companies. The idea was to create a completely new banking service and become the first to be able to offer online lending to bank customers.

In 2021, Unex Bank collaborated with Neofin, a no-code loan automation SaaS, to launch the first instant lending bank platform, Fresh Cash, which has become the first such bank lending platform of its kind in Eastern Europe.

This is the first loan product from a bank that has absorbed all the best of online loans:

Processing speed — it takes minutes from applying for a loan to receiving money.

Accessibility — an applicant receives money on the card of any bank without visiting offline offices and opening additional accounts.

Convenient online interface — the lending process takes only a few steps and is as automated as possible for both the client and the bank.

Thanks to this cooperation, Unex Bank got the following outcomes:

50% CAC reduction in the first 3 months

record number of new leads generated in the first quarter

launch of digital onboarding for all bank products

No-code software, not without reason, has become a global trend both among small businesses and startups and in huge corporations. The technology has many benefits and can be used for many purposes, especially in the financial sector.

And most importantly, these are the results that are usually evident in increased profits, streamlined workflow, and customer loyalty. Ready to test the Neofin platform? Start a free trial and launch your new lending product in one hour.