Lending software for credit unions

Neofin offers a no-code lending solution for credit unions to simplify onboarding and improve members' experience. We will cover all the member’s journey from the first touch at the digital branch through the decisioning and loan servicing.

With Neofin you will get:

Use an advanced lending management platform to give credit union members the most smooth and quick customer experience.

Personal instance in the cloud ready to be used in an hour after your request

Built-in product engine that helps deliver a new product to the members front in 15 minutes

Fully automated flow for your applications with the precise KYC, scoring modules, and decision engine

We are trusted by

What you can do with – Neofin

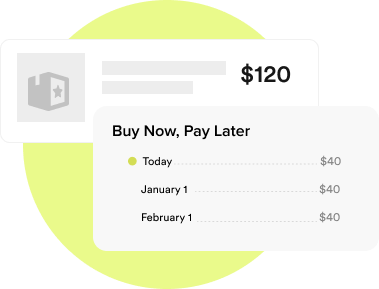

A module that allows any financial institution integrates with various merchants and seamlessly finance “buy now - pay later” purchases of the end users.

This way any financial organization can get new warm leads and grow the client base with a low acquisition cost.

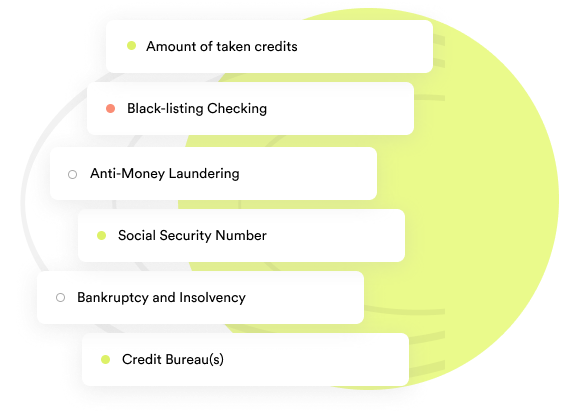

This module allows taking a credit decision in 1 to 15 minutes based on real-time data analysis. The engine includes over 150 criteria types, such as bankruptcy and insolvency verification, anti-money laundering checks, credit scores from sources like Experian/Equifax, and many more.

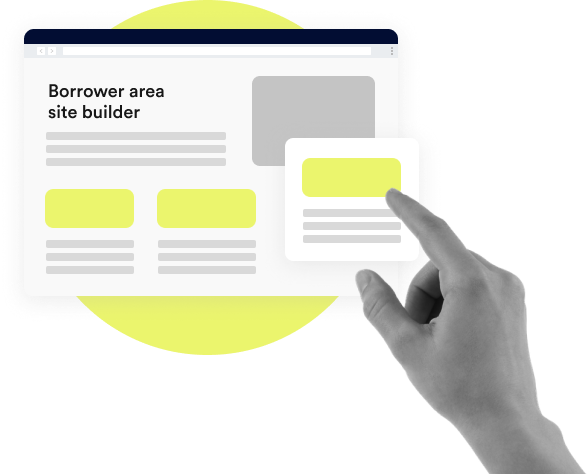

A website builder made of simple use, out-of-box site blocks tailored specially for credit unions.

This module provides all the needed instruments to run KYC quickly and smoothly: ai-powered 3D liveness detection, video verification, document recognition, client application forms, and data validation algorithms.

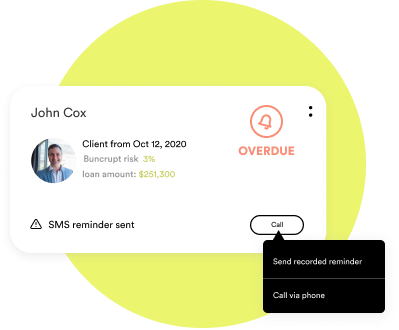

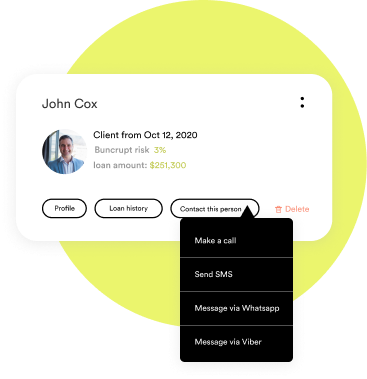

This module helps you optimize the work with debtors by involving various channels of communication, such as voice calls, SMS, and IVRs.

This module is built to help you manage all the leads, track their history, set tasks, push ai-powered notifications and run the analytics in a simple and intuitive admin panel.

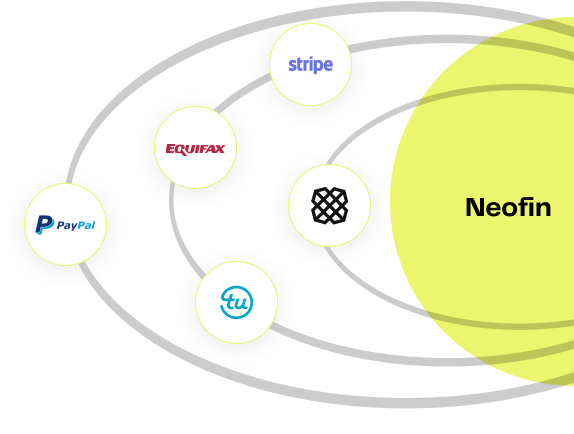

Integrations to boost your growth

We’ve partnered with third-party technology, scoring, servicing, and reporting solutions to make your lending process easy to use and smooth.

Cyber Security and Compliance