Loan Origination Software

Neofin offers a no-code loan origination software that allows financial institutions to optimize their lending operations by automating the borrower's journey.

Unlock your growth opportunities with Neofin’s loan origination software

We built a solution that helps you save operational time, reduce costs, optimize loan origination workflow, and increase return on technology investments.

Automate all stages of the borrower's journey from the online loan application, origination, and management to decisioning, underwriting, and collection.

Improve transparency between regulators, borrowers, investors, and departments and enable secure sharing of loan data and documents.

Integrate a no-code loan origination system to your product without the involvement of IT specialists.

Launch any lending business in as fast as 15 minutes, establish the credit products in 1 hour, issue credits, and earn the same day.

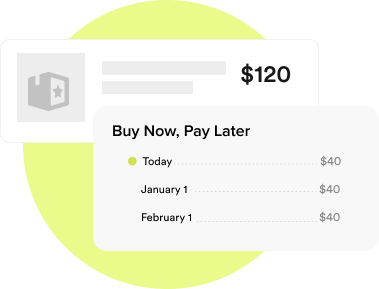

Pay only for modules that you use with our pay-as-you-go model.

We are trusted by

One platform to serve your business

No matter what type of loan you provide, Neofin covers you from inquiry to credit scoring, issuing, and verification.

Features you can add to your loan origination system

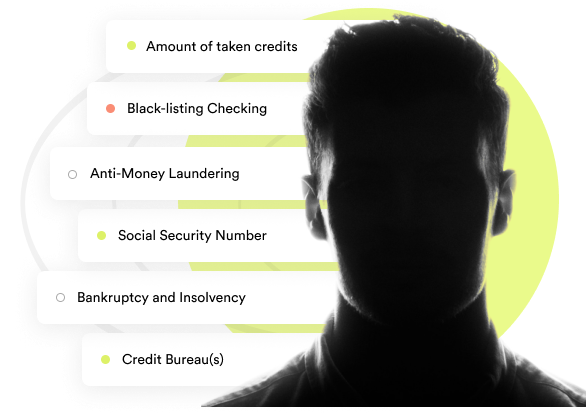

These modules allow taking a credit decision in 1 to 15 minutes based on real-time data analysis. The engine includes over 150 criteria types, such as bankruptcy and insolvency verification, anti-money laundering checks, credit scores from sources like Experian/Equifax, and many more.

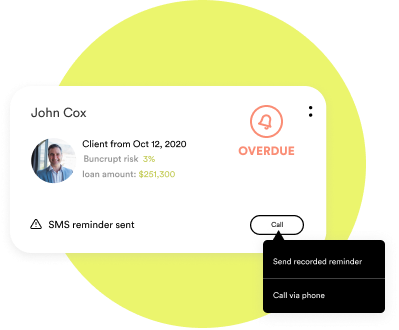

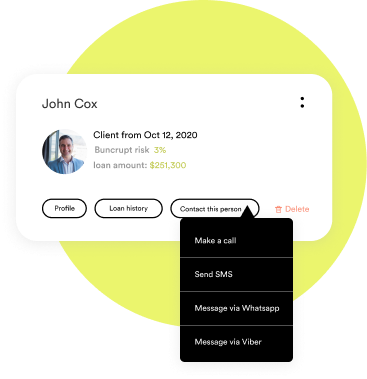

This module helps you optimize the work with debtors by involving various channels of communication, such as voice calls, SMS, and IVRs.

This module grants you a single place to manage and track all your credit programs, loans, and achieved metrics. It allows you to see it all in one place in a fully industry-secure cloud-based and constantly updatable environment.

Testimonials

Neofin has made our life so much easier. We have only registered a company and got the first license. We went live much faster than planned and became profitable on the 6th month of operation!

As for Neofin, their modular system is just perfect for such solutions. With them, we created a revolutionary product in the region which was live in a month (including all our internal work). And it is not just MVP but a fully working credit line.

Cyber Security and Compliance