Consumer banking templates for community banks that are ready for digital transformation

Engage your customers to use more your banking products. Grow your portfolio and get higher conversions in consumer lending

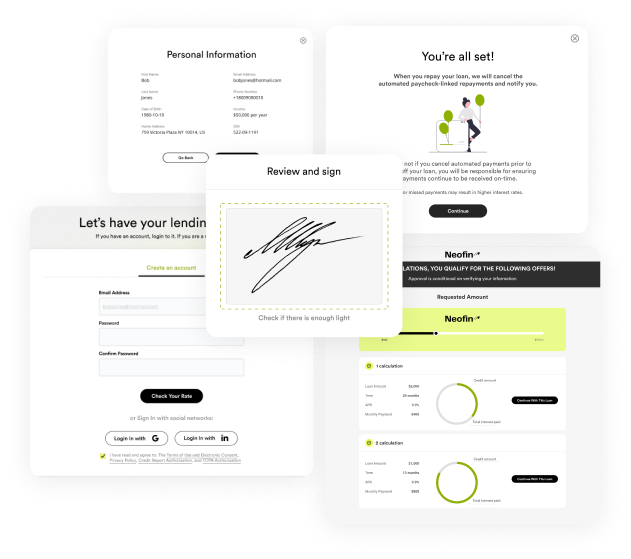

Build your next credit offering in a day

From application to scoring and servicing - Neofin combines it all for you to launch and test a new credit product

Complete white-label

Lightspeed deployment

Your secured Neofin instance will be ready to use in less than an hour at any of the popular platforms like AWS, GCP or Azure.

Willing to deploy Neofin in your private cloud cluster or on-soil server? No problems, it still takes hours to make it work with the help of instance images.

Strong lending ecosystem

Benefit from a set of out-of-the-box integrations with all the needed services for you to launch a new lending type:

Our banking segments

Consumer Lending

Student Loans

Loans

Personal Loans

Crypto Loans

Home Improvement Loans

Medical Loans

Point Of Sale Lending

Buy Now Pay Later/"Split Pay"

Pos Lease

Pos Financing

Same-as-cash

Automotive Lending

Title Loans

Subprime Auto Loans

Auto Lease

Recreational Vehicle Loans

Mid Prime Auto Loans

Business to Business Lending

Invoice fiinancing

Working Capital

Refactoring receivables

SBA

Small business Loans

Credit Limit

Payroll Advance

Construction Loans

Hard Money

Equipment Leases

Small Dollar Lending

Payday Loans

Tribal

Title Loans

Installment Loans

Cash Advance

Release the power of loans

Break the limits

Set yourself free of technology limitations switching to a no-code platform. All of the changes will be delivered to your borrowers in a few clicks.

Meet client expectations

Clients are always attracted by great experiences even more than with great commercials. Bring your borrowers experience to the next level and get popular at any local community

Corner the market

Become a main one-stop-shop financial marketplace for clients in your community. Let your bank’s brand associate with financial services for any purpose from life event loan to personal installment for the next big idea.

We are trusted by

Whom do we serve

Chief Operations Officer

Improve your lending business KPI’s in the first month after the launch of Neofin.

Always meet your deadlines in the launch of new loan products and sales channels.

Chief Lending Officer

Lending market becomes highly competitive and the price of leads growth.

Chief Digital/Innovation Officer

Switch manual processes into seamless digital journeys.

Increase lifetime value of your clients with new options of onboarding to loan products.