In a world of rising living costs, irregular income streams, and financial shocks, small dollar lending has emerged as both a safety net and a springboard. While originally built to offer fast relief for unexpected expenses, the sector is now evolving into a more sustainable, tech-enabled solution that supports long-term financial wellness.

At Neofin, we’ve worked with lenders and financial groups around the globe, many of whom are designing or optimizing small dollar loan products for modern borrowers. What we’re seeing is a shift: from short-term cash infusions to platforms that deliver real value, build trust, and lay the groundwork for financial inclusion.

Here’s what’s changing, and why it matters.

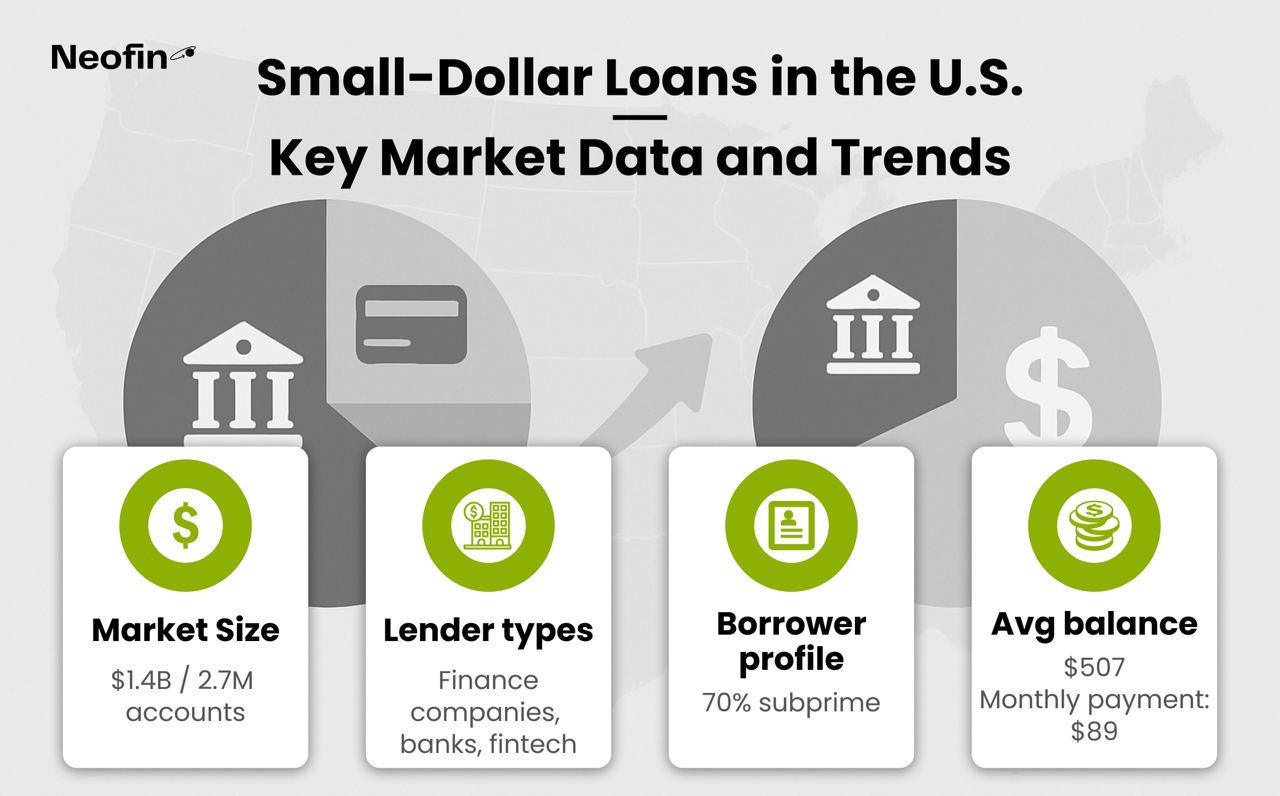

Total market size: As of Q4 2023, the small-dollar loan segment tracked by credit bureaus totaled $1.4 billion, spanning 2.7 million accounts, according to Federalreserve.

Types of lenders:

Finance companies: ~60% of balances ($835 million)

Banks and credit unions: 22% ($319 million), up from 6% in 2019

Fintech lenders: 13% ($181 million)

Borrower profile: Around 70% of loan balances are held by subprime borrowers (Equifax Risk Score below 620), indicating high financial vulnerability.

Average balance: $507

Average monthly payment: $89

Loan structure: About one-third are secured loans; approximately half feature fixed interest rates

Growing bank participation: Bank involvement rose significantly from 6% in 2019 to 22% in 2023

Use of alternative data: Financial institutions increasingly leverage banking history, gig income, and other non-traditional data points to assess creditworthiness and expand access

According to the U.S. Small Business Administration (SBA), demand for small-dollar credit is also growing in the small business sector. In FY2024 alone, over 3,000 microloans (under $150,000) were issued every month — with significant increases in lending to women, Black, and Latino entrepreneurs. This mirrors the consumer lending shift: targeted, tech-enabled, and inclusion-driven.

Small dollar loans are usually defined as personal loans under $2,500. Unlike payday loans, which are typically due in full by your next paycheck, modern small-dollar loans come with structured terms, transparent pricing, and flexible repayment plans. Borrowers use them to cover emergencies, bridge income gaps, or manage day-to-day needs.

They are especially important for:

Credit-invisible consumers

Gig workers and part-time earners

Individuals in underserved banking regions

Banks, credit unions, and digital lenders are all starting to see these borrowers not as high-risk, but as high-potential, provided the lending product is designed the right way.

For years, small dollar lending was seen as a short-term fix, something used only when all else failed. That’s changing.

Lenders are starting to use small dollar loans as an on-ramp to broader financial services. For example:

Some lenders now report repayment behavior to credit bureaus, helping borrowers build or repair credit.

Others offer rate discounts for repeat customers or those who complete financial education modules.

Many use these loans as a first product in a journey that could lead to savings tools, credit cards, or auto financing.

Small loans can drive loyalty, reduce acquisition costs, and increase lifetime value.

Regulatory scrutiny in this space is intense, and rightly so. Historically, the small dollar lending market has included products with opaque terms, high APRs, or punitive fees.

But in 2025, compliance isn’t a box to check. It’s a competitive advantage.

Here’s what responsible lenders are doing:

Aligning with CFPB and OCC guidance for small-dollar credit

Offering fixed installment terms rather than balloon payments

Using ability-to-repay models based on real-time income data

There’s also growing policy support. In the U.S., for example, several state-led initiatives are encouraging community banks and credit unions to launch small dollar loan programs, with backing from the FDIC.

Embedded finance and lending APIs are some of the biggest drivers of innovation.

Fintech platforms and SaaS providers now make it possible to:

Automate decisioning with alternative data (banking history, utility bills, gig income)

Create loan offers inside third-party platforms (like a BNPL button at checkout)

Set up modular compliance workflows with real-time alerts and audit trails

For example, with Neofin’s no-code lending engine, our clients can launch fully compliant small dollar lending products in weeks, not months. They can integrate fraud checks, credit scoring, and repayment automation with just a few clicks.

This tech-stack flexibility is critical. Because small-dollar lending needs to be fast, fair, and scalable, all at once.

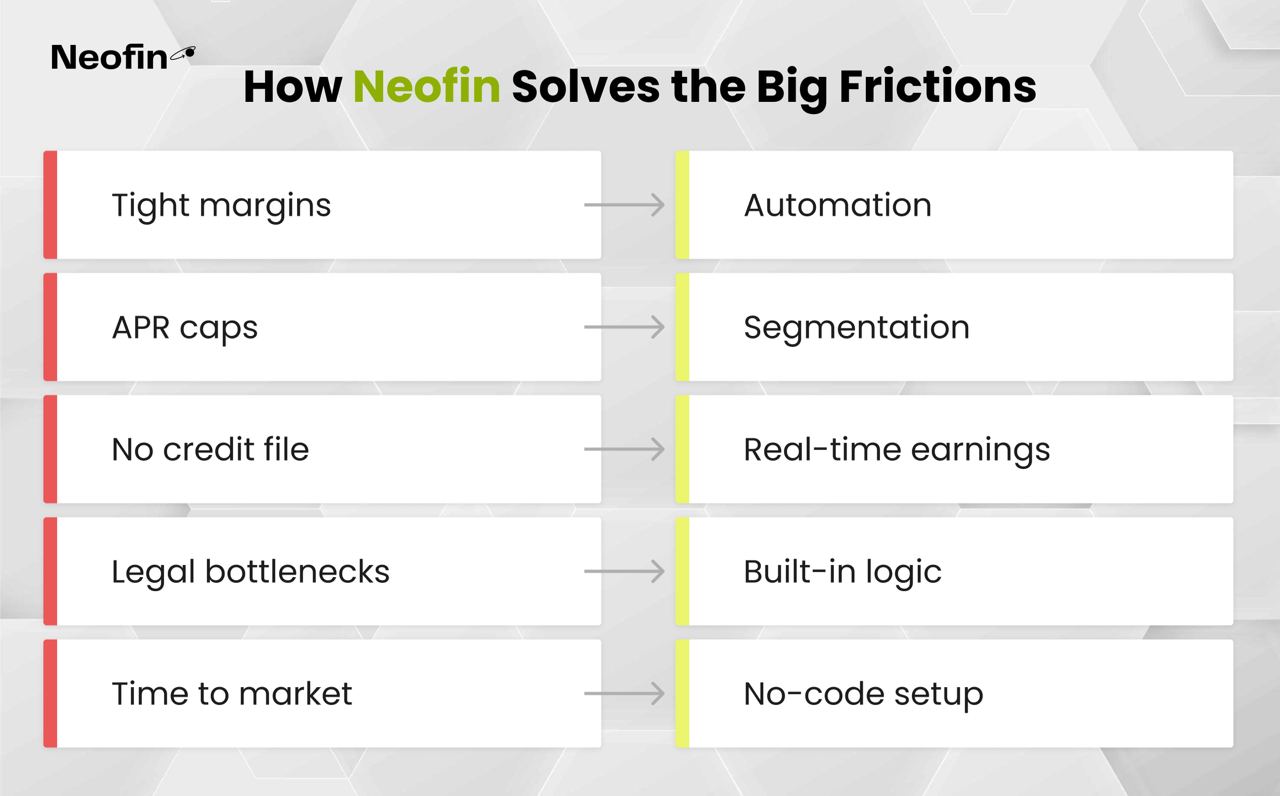

Getting small-dollar lending right isn't easy. These are the issues teams run into, and how Neofin deals with them:

Margins are tight. Ops are heavy.

Manual work slows everything down. We automate decisioning, servicing, and compliance out of the box.

APR caps limit pricing flexibility.

Neofin clients segment users better. They use income data and behavior patterns to build offers that stay within the rules, and still make sense.

No credit file? No problem.

We support workflows that use real-time earnings, banking history, and custom scorecards.

Compliance slows teams down.

Built-in logic, required docs, and audit logs reduce back-and-forth with legal and risk.

Time to market drugs.

Teams using Neofin launch in weeks, not quarters. No-code setup. No surprises.

If you’re blocked by old systems or waiting on dev bandwidth, we help move things forward. Let me know if you want this dropped into the article.

Neofin works with lenders worldwide, from lending groups to emerging one-brand digital lenders. Here's what they value:

Loan portfolios in the billions processed through our platform

Over 100,000 loans managed daily

Active operations in 13 countries across 3 continents

Every member of our team comes from a banking or fintech background

Tech teams at large financial institutions rely on us to handle lending so they can focus on product and growth

If you’re launching a new lending product, growing in a new region, or looking to streamline internal tools, Neofin helps you do it faster, with less overhead.

According to data from the FDIC and World Bank, demand for small dollar lending is increasing across every continent, with digital lenders leading the charge.

We expect to see:

More hybrid models partnerships between traditional banks and fintechs

More “invisible” loans embedded in apps, platforms, and services consumers already use

More financial health tools loans connected to savings, education, or behavioral nudges

“5 years ago, microfinance operators reached out to Neofin looking to automate their operations and optimize performance. In 2025, we see more and more lenders willing to contribute to financial literacy, strengthen their communities, and loan automation becomes one of the means to achieve this. This is a major shift of context, and we love being a part of it”, - says Svitlanka Sergiichuk, Neofin CEO.

Done right, small dollar lending isn’t just a product. It’s a platform.

It builds relationships. It enables inclusion. And in 2025, it might be one of the most strategic tools in your lending portfolio.

At Neofin, we help lenders design and launch compliant, digital-first small dollar loan programs at scale. Whether you’re serving consumers, SMEs, or new-to-credit populations, we’re here to power what’s next.