The global digital lending platform market is set to grow from $15.85 billion in 2024 to $19.37 billion in 2025, a 22.2 % CAGR, fueling demand for modern LMS solutions

56% of lenders say manual servicing is their top growth blocker. Borrowers expect approvals in minutes, not days, and regulators demand airtight compliance at every step.

"Too many lenders still patch together tools that weren’t built for lending. That’s a cost center, not a growth engine. A real LMS should cut time-to-fund, flag risk early, and let teams focus on lending, not spreadsheets."

— Svitlanka Sergiichuk, CEO at Neofin

To keep up, lenders need a loan management system (LMS) that streamlines origination, servicing, and repayment while reducing errors and operating costs. Below, we outline the essential LMS features every modern lending institution needs to stay competitive in 2025.

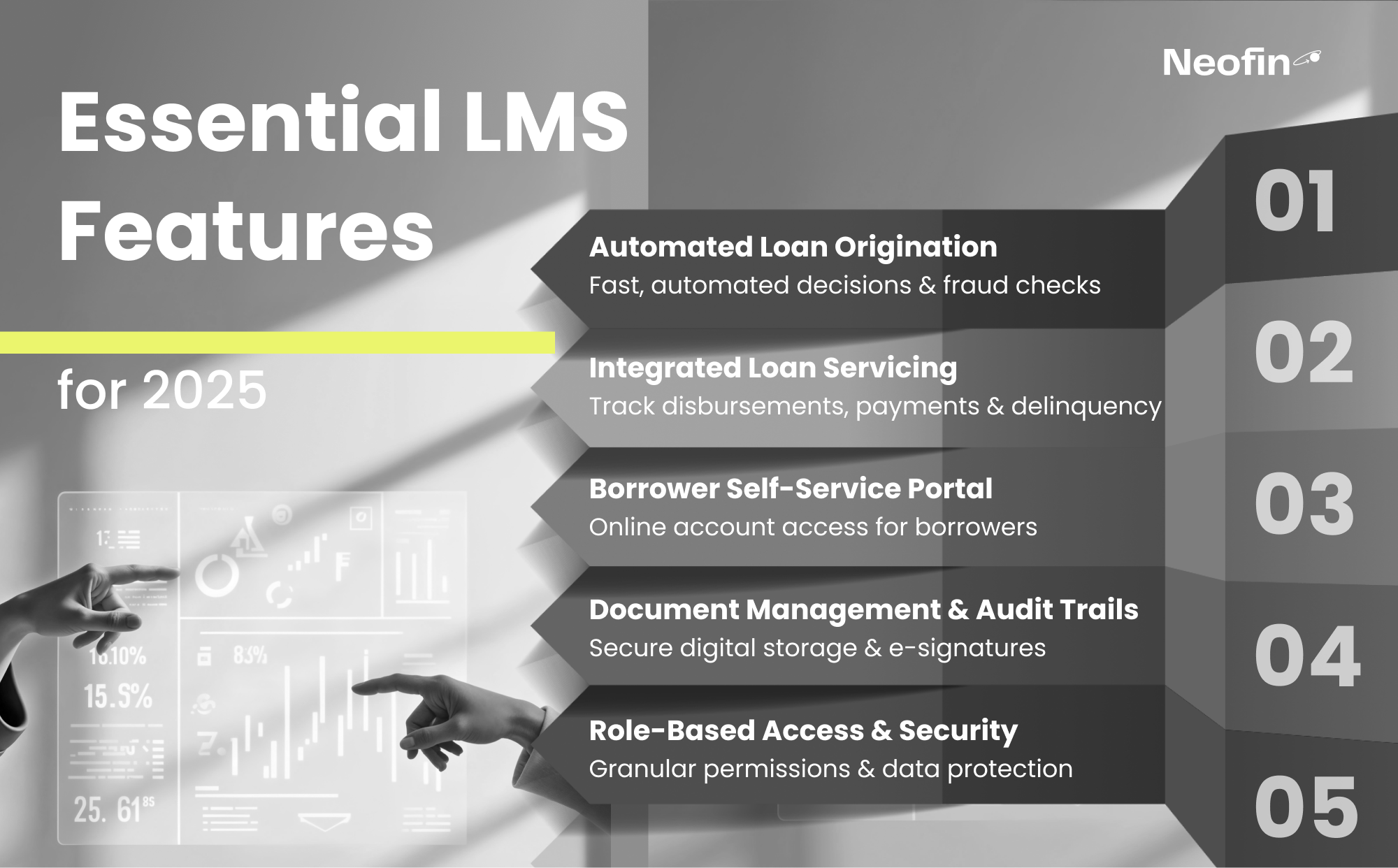

What it does: A front-end and a back-end system that features a digital application portal, compliant borrower data collection, performs fraud checks, scores credit, and delivers decisions according to the desired percentage of automation.

Why it matters: Shrinks time-to-approval from days to minutes, cutting manual effort and cost.

Includes: Dynamic decision engine, KYC/AML workflows, integrations with credit bureaus and other external data sources, including the alternative data that is needed for KYC and credit-worthiness assessment.

What it does: Back-office, functionality suite and dashboards for managing disbursements, schedules, interest, and collections.

Why it matters: Improves efficiency, reduces delinquency, and enables real-time visibility into portfolio health.

Features: Flexible amortization, auto-pay setups, delinquency alerts.

What it does: Gives customers full access to their loan accounts online — with a possibility to update payment methods, track the repayment statuses, request for additional services etc.

Why it matters: Lowers support costs and boosts borrower satisfaction.

Includes: Statements, payment options, modification requests — all from one portal.

What it does: Centralized digital storage of contracts, notes, compliance/verification documents, and correspondence with version control and e-signatures.

Why it matters: Simplifies audits and ensures regulatory compliance.

Includes: Immutable logs, auto-indexing, encrypted storage.

What it does: Restricts access based on user roles, with multi-factor authentication and encryption.

Why it matters: Safeguards sensitive borrower data and maintains data integrity.

Includes: SOC 2-ready architecture, full audit trails, granular permissions.

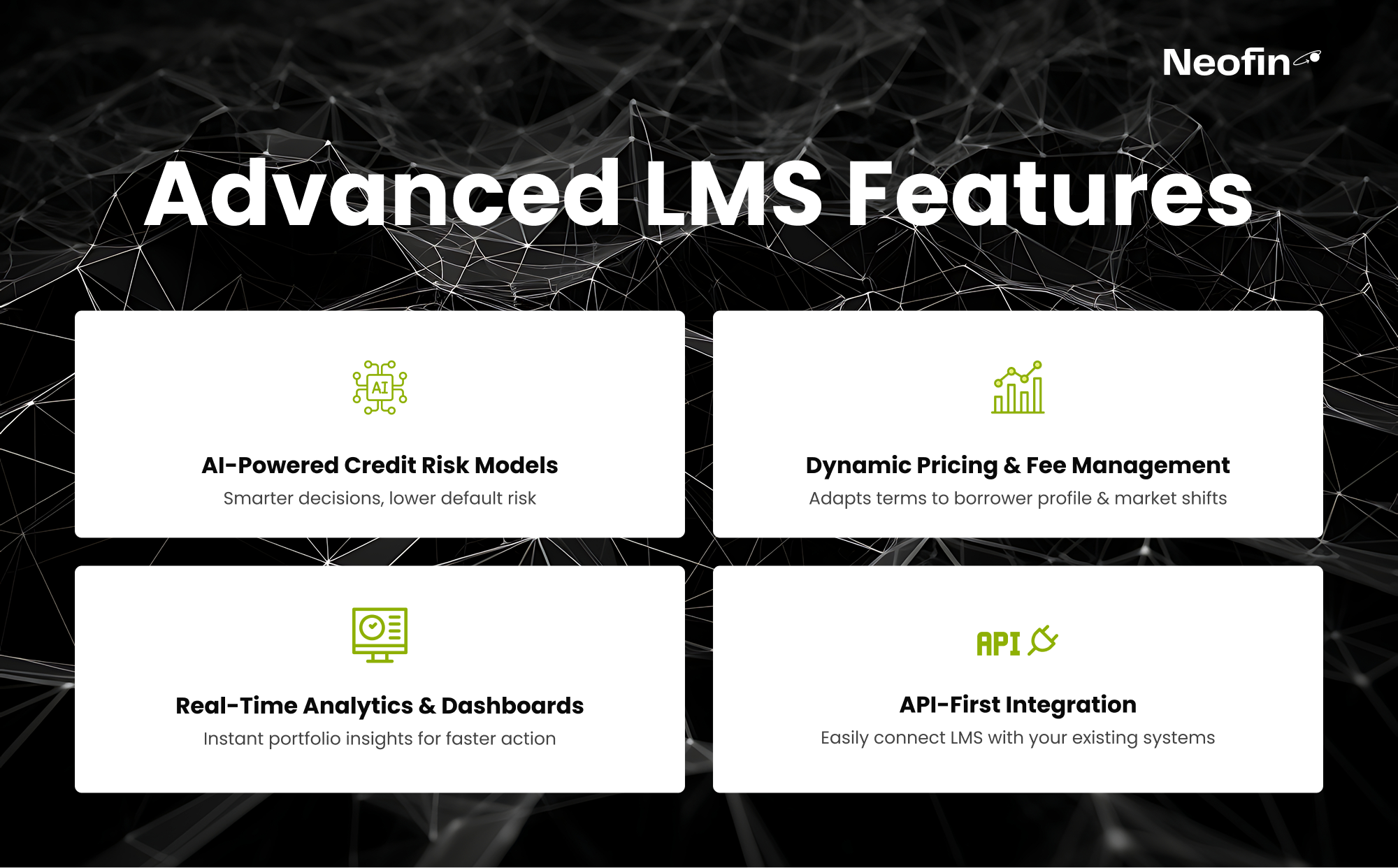

What it does: Analyzes historical data, borrower behavior, and external signals to enhance decision accuracy.

Why it matters: Reduces default risk and helps lenders approve more creditworthy applicants.

Bonus: Integrates seamlessly with underwriting and loan pricing modules.

What it does: Automatically adjusts interest rates, fees, and terms based on borrower profiles or market conditions.

Why it matters: Optimizes revenue while staying competitive.

Use Case: Higher loan amounts may trigger tiered fees or collateral requirements.

What it does: Tracks key metrics like approval rates, delinquency trends, and borrower satisfaction in real time.

Why it matters: Enables faster decisions and continuous performance improvement.

What it does: Enables easy connections to CRMs, core banking systems, payment gateways, and ID verification tools.

Why it matters: Reduces development time and creates a unified tech ecosystem.

Choosing a modern LMS means choosing growth:

Pre-Built Integrations Connect instantly with tools like Salesforce, HubSpot, and QuickBooks.

Flexible Deployment Cloud, private cloud, or on-premise, depending on compliance and control needs.

Multi-Jurisdiction Ready Supports local currencies, compliance formats, and languages as you scale.

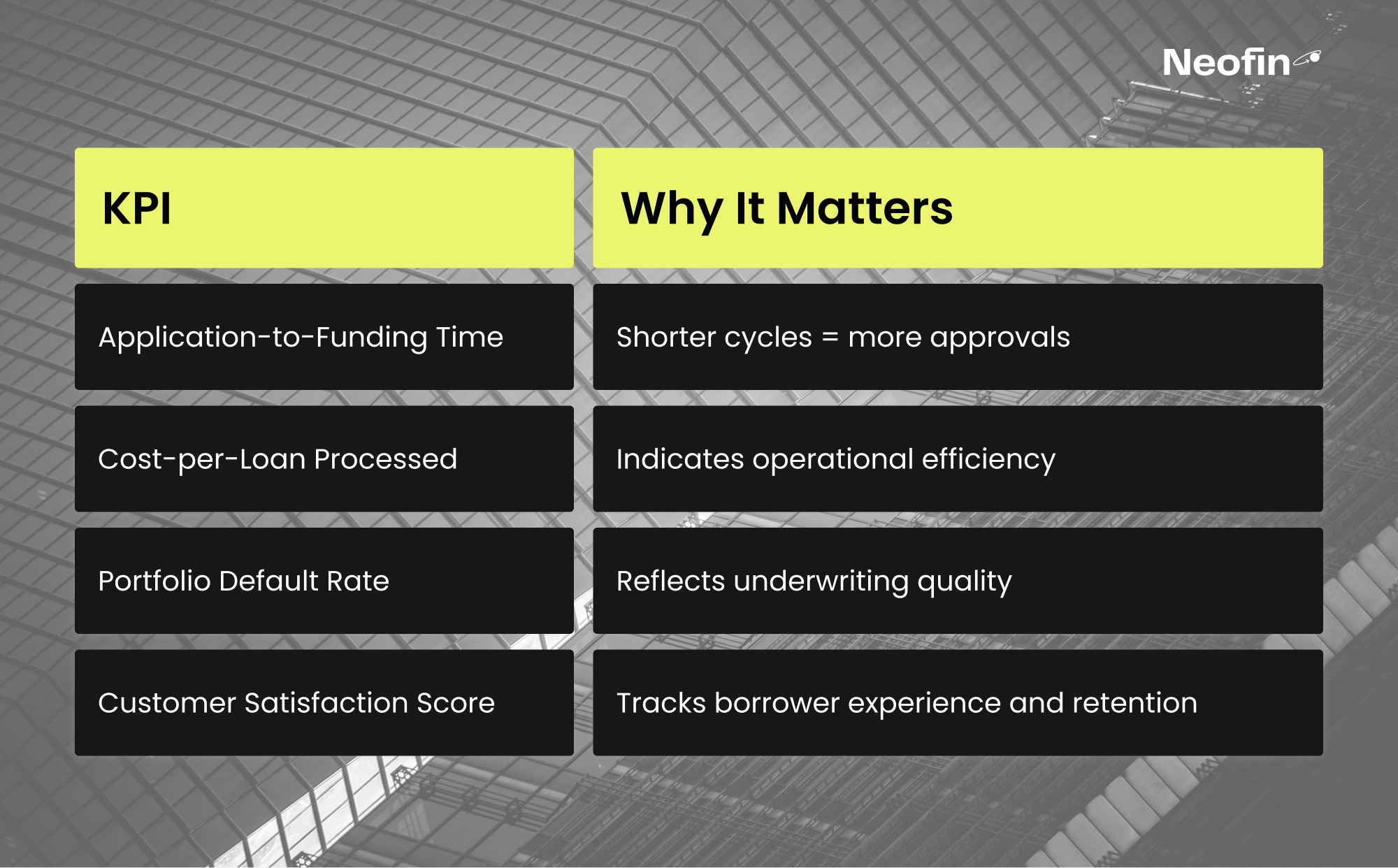

Application-to-Funding Time

The faster you move from application to disbursement, the higher your conversion rate and loan volume. In digital channels, 2–5 minutes is the benchmark for small-ticket loans. Measure from form submission to cash in the customer’s account. Cut time by stripping out manual checks: pre-filled forms, direct bureau APIs, automated KYC.

Cost-per-Loan Processed

Break the cost down—scoring, KYC, call-center, document handling. Compare online vs. branch channels and prime vs. near-prime segments. Drive costs down with robotic checks, borrower self-service portals, and consolidated cloud platforms that replace scattered legacy systems.

Portfolio Default Rate

The headline number is meaningless without product slices, cohort views, and A/B tests of scoring rules. Set guardrails (e.g., “early-stage delinquency < 4 % at 30 days”) and trigger early-collection workflows. Defaults fall not only with better scoring but also with adaptive repayment schedules and automated reminders.

Customer Satisfaction Score (CSAT / NPS)

High CSAT lowers churn and acquisition cost—happy borrowers return and refer. Survey right after key touchpoints: approval, payoff, support interactions. Lift the score with micro-UX wins: transparent payment calculators, real-time status updates, and one-click restructuring options.

Feed all four metrics into a single dashboard. When you can show fast decisions, low processing costs, controlled risk, and loyal customers, it’s far easier to justify budget for further automation and scaling.

Audit Your Existing Process: Identify bottlenecks, duplicated work, or compliance gaps.

Launch Core Capabilities First: Start with automated origination, document handling, and decisioning logic.

Enable the Right Teams: Assign clear access roles, train users, and monitor activity.

Measure and Optimize: Track the KPIs listed above, then add analytics and risk modeling to scale further.

See these features in action. Book a demo of Neofin’s Loan Management System and discover how lenders are cutting costs and increasing approvals in 2025.