Small business lenders face rising demand, new regulatory pressures, and fierce competition from neobanks and digital-first platforms. According to Allied Market Research, the loan management software market was valued at $5.9 billion in 2021, and is projected to reach $29.9 billion by 2031, growing at a CAGR of 17.8%. North America alone accounts for 48% of the market, driven by lenders looking to digitize faster, reduce risk, and offer smarter, more compliant products.

The right loan management software (LMS) becomes your infrastructure, not only to scale your lending business, but to stay compliant and delight borrowers.

But with hundreds of vendors offering variations of "end-to-end lending platforms," how do you pick the right one? Explore the top loan management software platforms for small business lenders, comparing functionality, flexibility, scalability, and cost, plus where Neofin fits into the picture.

Small business lending software is a digital platform designed to manage the entire lifecycle of a business loan, from origination and underwriting to servicing and collection.

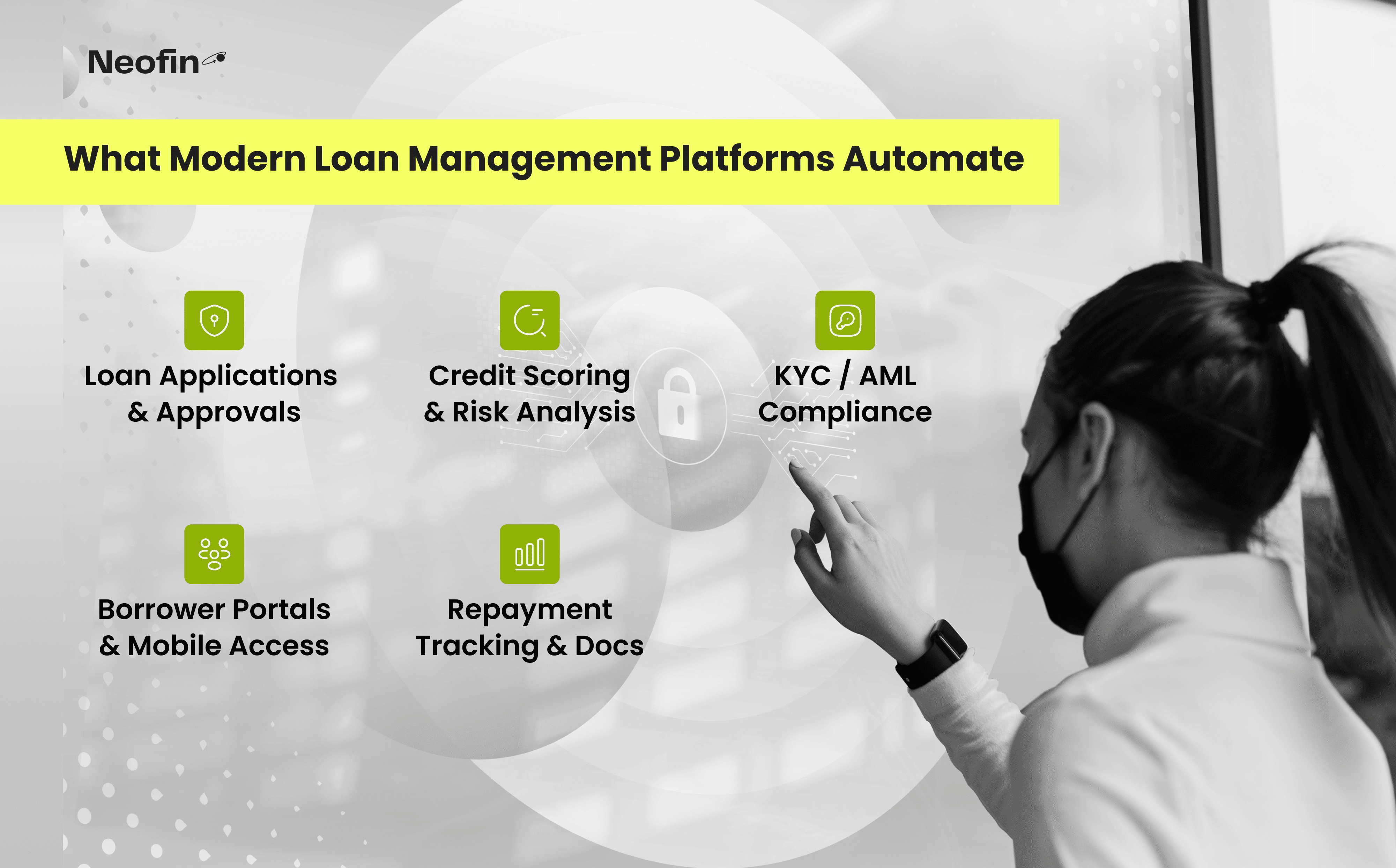

These platforms help automate:

Loan applications and approvals

KYC/AML verification and compliance workflows

Credit scoring and risk analysis

Repayment tracking and document generation

Customer service via borrower portals or mobile apps

Faster loan approvals

Automated intake, pre-qualification, and workflows reduce approval time from days to minutes.

Streamlined servicing

Auto-scheduled payments, reminders, and updates cut missed payments and free up staff time.

Fewer manual errors

Standardized logic and workflows reduce risk and simplify audits.

Built-in compliance

Rule-based disclosures, data logs, and templates help meet SDLR, CCD2, and GDPR requirements.

Scalable operations

Same system supports 100 or 10,000 applications, no need to rebuild workflows.

Better borrower experience

Borrowers get status updates, faster decisions, and access to their accounts anytime.

Below is a list of leading loan management software solutions for 2025. Selected for their ability to help lenders streamline operations, launch products faster, and stay compliant. We break down the strengths, use cases, and pricing of each platform to help you choose the right fit for your lending business.

Best for: Digital lenders, fintech startups, and financial groups launching small business or revolving credit products in multiple markets.

No-Code Loan Origination System: Launch custom SMB loan flows without developer involvement.

Product Builder: launch any SMB lending product you need, including term loans, lines of credit, B2B BNPL and others.

Modular Lending Stack: Plug-and-play KYC that supports LLCs and private entrepreneurs, scoring, servicing, CRM, and document management.

Audit-Grade Compliance: ISO 27001, GDPR, SOC 2 Type II with quarterly external audits.

Cluster-Based Architecture: Every client gets a dedicated single-tenant environment.

API Integrations: connect with all the external services you need to run small business lending, from KYC and open banking to payment processors and call centers.

Neofin allows lenders to test and launch new loan products in days. Whether it’s a line of credit for small contractors or a BNPL model for SME retailers, the system adapts with zero code and full compliance baked in.

Best for: Tech-heavy lenders with in-house development teams.

Flexible servicing for revolving lines, installment loans, leases, and more.

Powerful APIs for creating, updating, and tracking loans.

Real-time analytics, status tracking, and compliance tools.

Highly scalable and adaptable to diverse lending models.

Strong integration capabilities through its API-first design.

Complexity and cost may be prohibitive for startups.

Requires more technical onboarding.

Best for: Lenders wanting advanced credit modeling.

AI-based risk scoring engine.

No-code workflow builder for tailored approvals.

Custom UI/UX modules.

Accelerates loan approvals with AI-driven credit scoring.

Flexible workflow automation adapts to various lending processes.

Advanced features may require a longer implementation period.

Higher cost may be prohibitive for smaller lending institutions.

Best for: UK-based SME and microlenders.

Built-in document management system.

Simple loan origination, reporting and servicing tools.

Very easy to use.

Designed for compliance.

Not suited for scaling or global use.

Limited customization.

Best for: Banks offering SME, mortgage, or mixed product portfolios.

End-to-end loan origination flows.

Advanced risk modeling with bureau integrations.

Customizable workflows.

Suitable for a broad range of loan types.

Solid architecture.

Higher price point.

Long setup time.

With lending becoming more real-time, contextual, and competitive, your technology stack is your biggest differentiator.

For small business and revolving credit lenders, the ideal platform should offer:

Fast product launches

Flexible APIs for embedded finance

Audit-ready compliance

Low-code/no-code configurability

Scalability across markets and volumes

Neofin stands out in this new wave, particularly for fintechs, B2B lenders, and SMB-focused institutions looking to embed lending without starting from scratch.

Visit neo-fin.com to explore more.