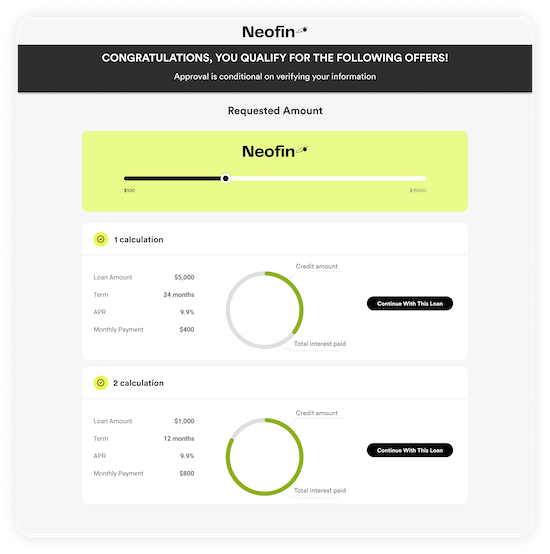

Less friction in the launch and maintenance of your lending flow. All customizations delivered in real time mode

Auto data collection from open banking accounts and wage information Plaid, Argyle, Highline, PrysmData

Integrated all needed risk tools from main data providers Equifax, Experian, TransUnion, Microblink, LexisNexis and

Automated loan funding by card number, account routing number or account token. Connected payment gateways ACHQ, Payliance and Repay.

End-to-end no-code platform to extend your digital lending process

Neofin is the first no-code loan automation platform that offers mixed pricing combining subscription and pay-as-you-go models.

spent to build, tune and tweak our no-code lending automation platform

seamlessly issued through Neofin every day

total experience in the banking and fintech industry in the core team

continents of operation

Neofin is proud to win a position in the top 10 and become a part of exclusive Equifax Product Studio

Neofin is an awardee of the Fintech & E-commerce Linking Days Awards in Poland

Neofin is partnering with Mastercard in MENA to drive the card-enabled lending automation in the region

Neofin is a recognized innovator in the US Dept of State’s Global Innovation through Science and Technology (GIST) initiative

Cyber Security and Compliance