The General Data Protection Regulation (GDPR) defines how personal data of EU residents must be handled. Any lender, whether based inside or outside the EU, is required to follow this law if they process data belonging to EU individuals.

The regulation demands that data be collected for specific purposes, kept accurate, stored only as long as needed, and protected against unauthorized access. Lenders must also be able to explain their data handling choices and show records of how and why data was processed.

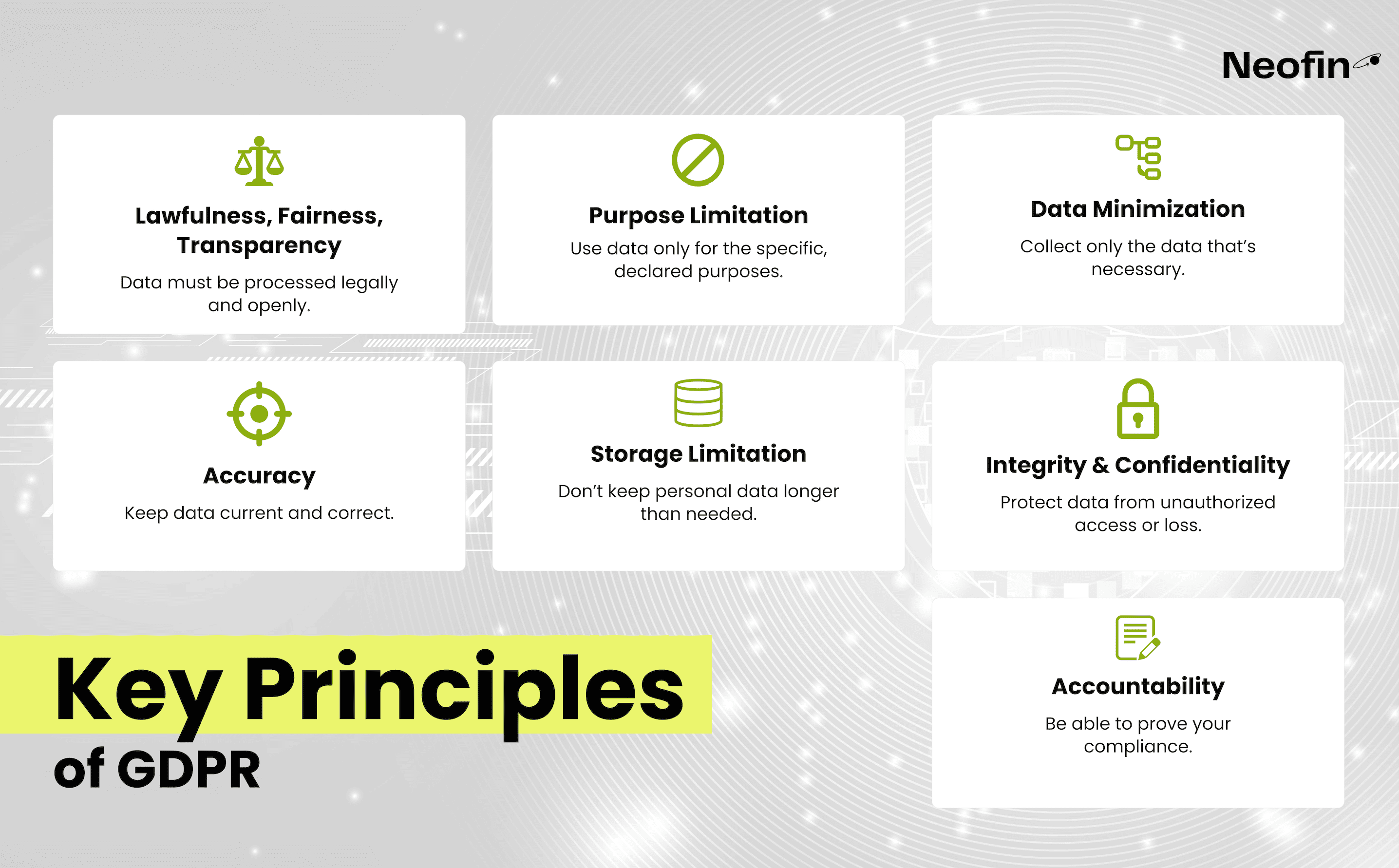

Key principles of GDPR include:

Lawfulness, fairness, and transparency

Purpose limitation – data should only be used for declared, specific goals

Data minimization – collect only what's necessary

Accuracy – ensure data is current and correct

Storage limitation – data shouldn’t be held indefinitely

Integrity and confidentiality – data must be secured against unauthorized access

Accountability – lenders must prove compliance

GDPR is a foundational trust signal in European markets. For lenders leveraging Neofin to automate origination, credit scoring, and onboarding, aligning with GDPR has both strategic and compliance benefits:

Trust and Brand Value: Transparent data practices improve customer retention and reduce abandonment during application flows.

Risk Mitigation: GDPR non-compliance can lead to fines of up to €20 million or 4% of global annual revenue.

Embedded Compliance: As lending becomes more integrated into third-party platforms, embedded finance solutions must build privacy in from the start.

People who apply for credit or use lending services in the EU have rights under GDPR. Lenders must uphold these rights:

Right to Access: Borrowers can request a copy of their personal data.

Right to Rectification: Incorrect data must be corrected.

Right to Erasure (Right to be Forgotten): If the data is no longer needed or consent is withdrawn, users can demand deletion.

Right to Data Portability: Users can transfer their data to another provider.

Right to Object and Restrict Processing: Especially important in marketing and profiling contexts.

Right Not to Be Subject to Automated Decision-Making: A human review must be available if a loan denial is solely algorithm-based.

Be ready to respond to these requests on time, with clear records showing what actions were taken.

Privacy refers to the limits placed on how data is used. Security covers the measures taken to prevent loss, theft, or unauthorized access.

A lender might have secure systems but still break GDPR rules if they use data in ways they did not explain to the customer. Both elements need to be addressed. Neofin’s infrastructure supports privacy compliance through policy controls and secure workflows.

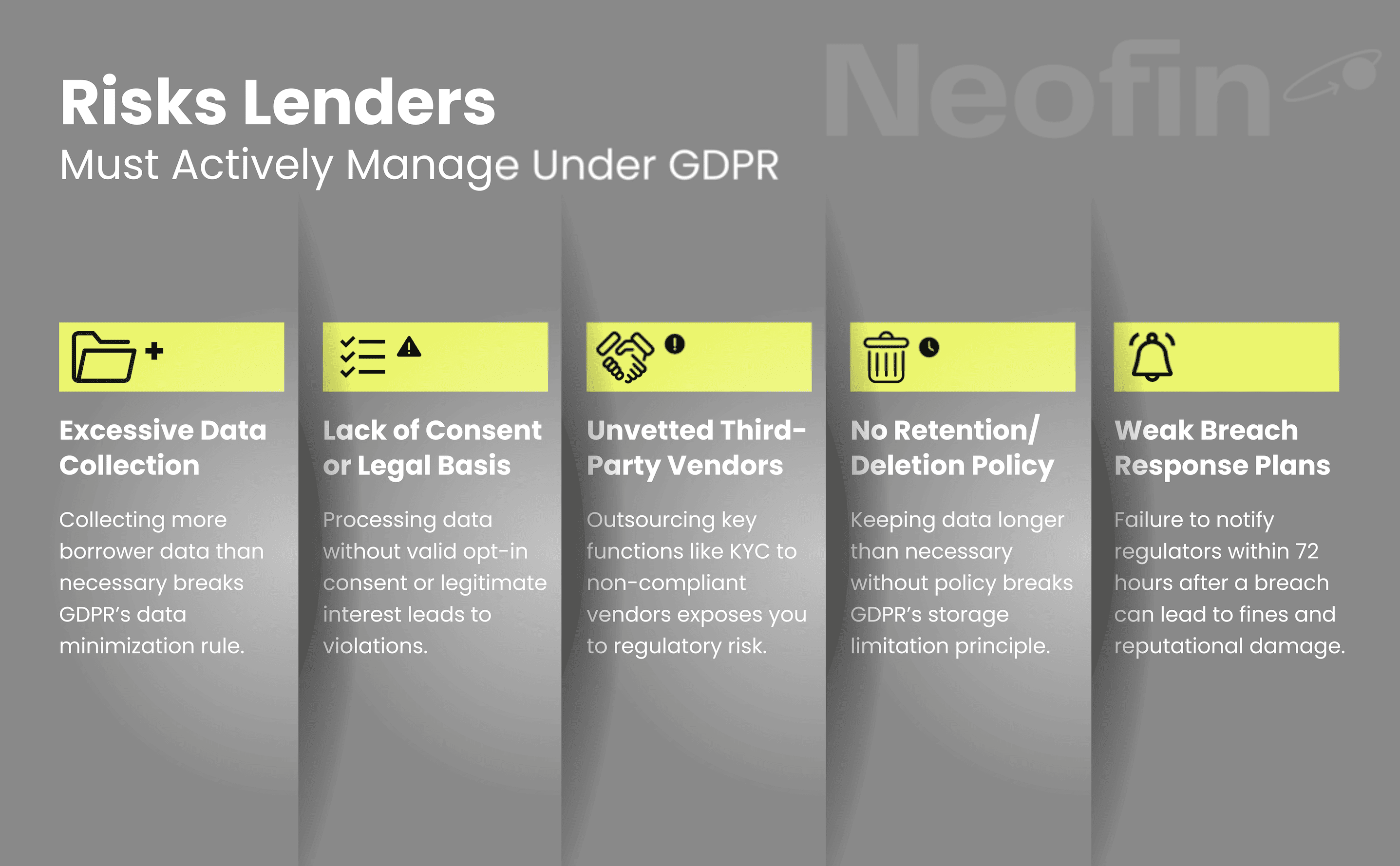

Some lenders collect more information than they need or fail to set time limits for data storage. Others rely on outside service providers without confirming whether they meet GDPR standards.

Another risk is failing to delete data when it's no longer needed. These problems can lead to fines or service disruptions. Clear internal rules, proper audits, and working with vendors who understand GDPR can prevent most of these issues.

To meet GDPR expectations, lenders must know what data they collect and why. That means keeping records of data flows across every part of the loan process. These records should include where data is stored, how long it is kept, and who can access it.

Lenders must take a structured approach to compliance:

Data Mapping

Know what data you collect, where it’s stored, how it flows, and who can access it.

Policy Development

Create a clear data privacy policy, tailored to your lending workflows, that outlines lawful processing, retention, and user rights.

Automation Tools

Use platforms like Neofin that provide modular, customizable lending workflows with built-in GDPR compliance features.

Ongoing Training

Educate all staff. Especially operations, IT, and customer-facing roles, on GDPR basics and internal policies.

Monitoring and Review

Treat privacy compliance as an ongoing effort, not a one-time checklist.

Loan decisions made by software without human input must follow special rules under GDPR. Borrowers can request an explanation of the decision and ask for a review by a person.

Lenders must make sure their systems can support this. If someone is declined for a loan, the platform must be able to show what data was used, how it was scored, and offer a manual review path.

Neofin gives lenders full control over automated flows, with logs and configuration options to support GDPR requirements.

How to Handle Data Breaches Under GDPR

If a lender loses personal data or suspects that someone accessed it without permission, they must report the incident to the relevant authority within 72 hours. If the breach could harm individuals, they must also inform those people.

Even small incidents must be documented. Lenders should keep clear logs and be ready to explain what happened and how they responded. A tested plan saves time and helps limit damage.

Aligning with globally recognized standards supports both GDPR compliance and operational excellence:

ISO/IEC 27701: Directly maps to GDPR requirements and enhances your privacy posture.

ISO/IEC 27001: Secures information systems, protecting personal and transactional data.

SOC 2: While not EU-specific, it strengthens internal controls over data handling. Relevant for B2B lenders and platform providers.

Lenders using Neofin benefit from architecture designed to support these frameworks out of the box.

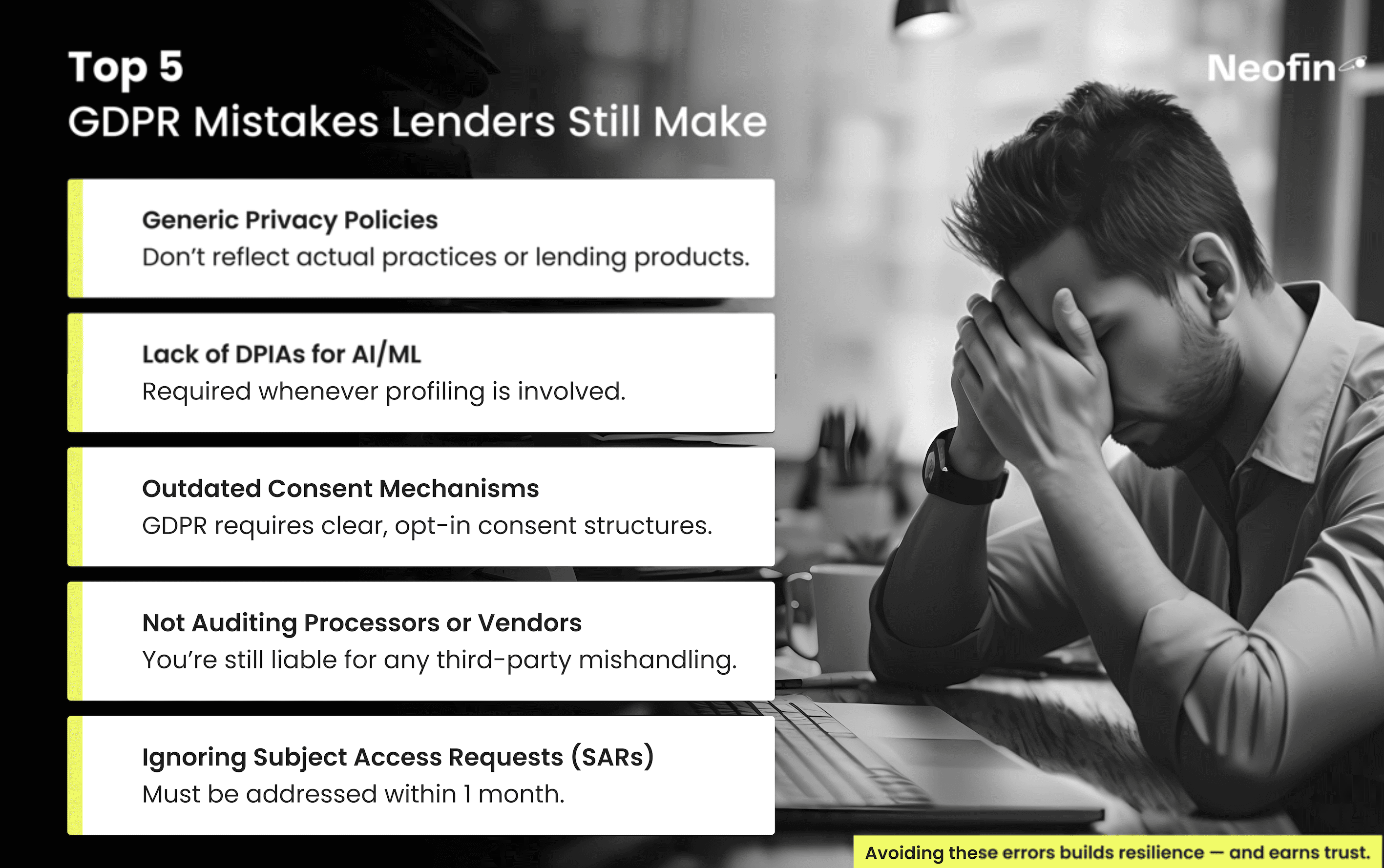

Many lenders rely on general-purpose privacy statements that don’t reflect how their lending products work. Others forget to run Data Protection Impact Assessments (DPIAs) before launching credit scoring tools or automated onboarding flows.

Mistakes also occur when institutions assume third-party vendors will handle GDPR compliance for them. In reality, the responsibility stays with the lender. Even tools like automated underwriting studios must be configured with audit and transparency in mind.

A clear privacy governance model combined with updated staff training and reliable internal tools prevents these issues.

Clear privacy rules improve customer trust, reduce the risk of disputes, and help organizations meet requirements across different jurisdictions. Well-documented data processes also lead to smoother audits and faster regulatory response times.

For lenders using no-code lending software and automation-friendly compliance workflows, staying current with GDPR doesn’t slow down innovation. Instead, it becomes a scalable part of growth.

Data privacy policies that are built into core workflows. Rather than handled as an afterthought, make lending platforms more stable and trustworthy over time.

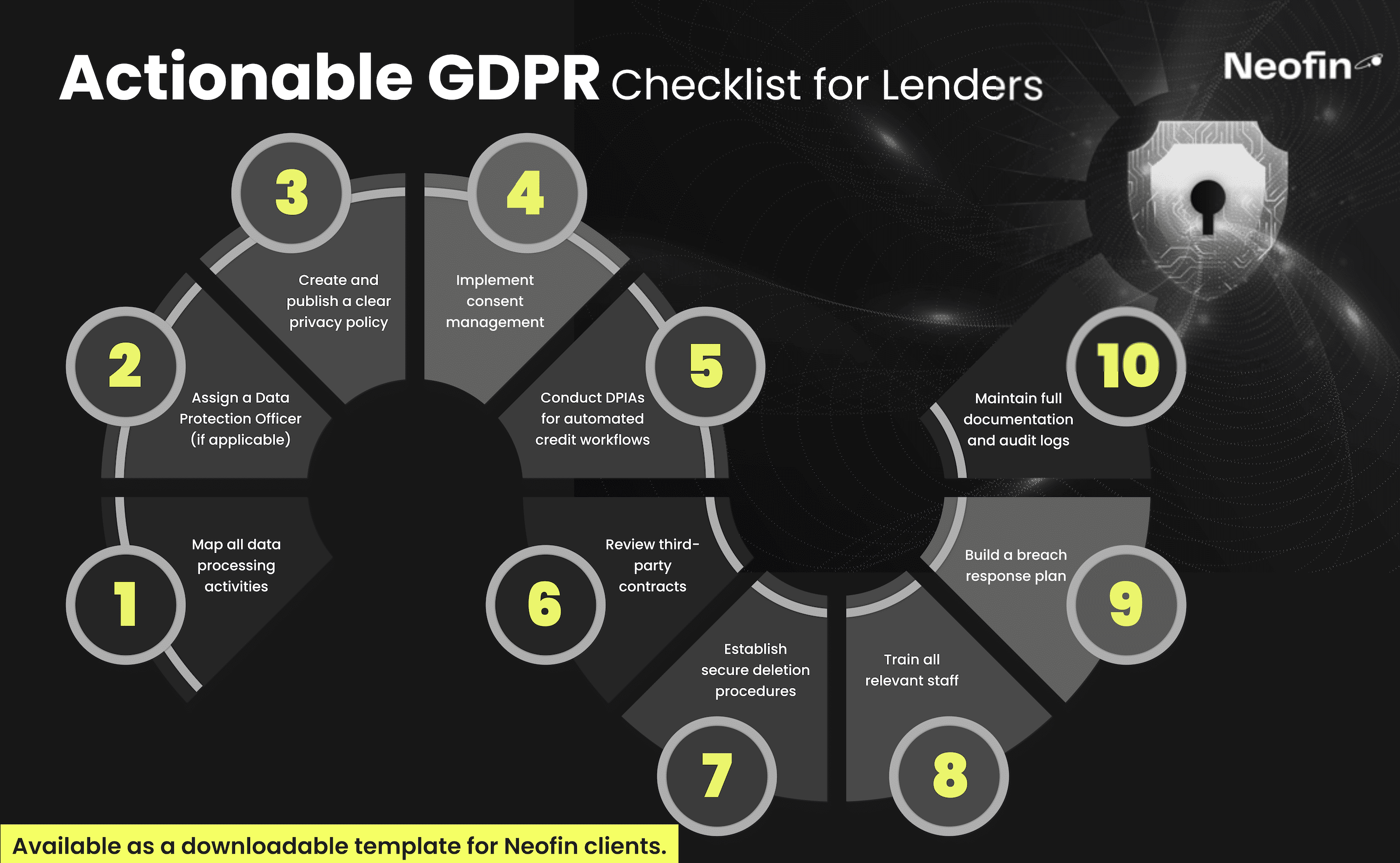

Actionable Checklist for Lenders

Map all data processing activities

Assign a Data Protection Officer (if applicable)

Create and publish a clear privacy policy

Implement consent management

Conduct DPIAs for automated credit workflows

Review third-party contracts

Establish secure deletion procedures

Train all relevant staff

Build a breach response plan

Maintain full documentation and audit logs

Final Thoughts on GDPR and Lending

GDPR shapes how digital lending products are built and how data moves through scoring, onboarding, and servicing. For lenders working across European markets, it’s a baseline requirement, not just for compliance, but for being taken seriously.

Neofin gives teams the tools to structure data flows, respond to access requests, and manage decision logic with audit-ready precision. Privacy isn’t an extra feature. It’s part of how the system works.

If you're building for scale in regulated markets, that difference matters.