In 2025, small-dollar lending is no longer a fringe financial product. With the cost of living rising and access to traditional credit tightening, loans under $2,500 are becoming a vital tool for millions of borrowers, from gig workers to small business owners.

But with growth comes regulation.

In the United States, the Consumer Financial Protection Bureau (CFPB) has enacted the Small-Dollar Loan Rule (SDLR), triggering major compliance shifts for lenders. Across Europe, the revised Consumer Credit Directive (CCD2)is tightening control over similar products, alongside strict data rules under GDPR.

This article breaks down how small-dollar lending is regulated in both regions, how the rules differ, and how automation, specifically platforms like Neofin, helps lenders stay compliant and launch faster.

In early 2025, the CFPB finalized the Small-Dollar Loan Rule (SDLR): a regulatory framework designed to curb predatory practices and bring greater transparency to small personal loans. The rule targets payday-style lending models while creating room for responsible innovation.

Ability-to-Repay (ATR): Lenders must assess whether a borrower can reasonably afford the loan based on verified income, expenses, and obligations.

Disclosure Rules: Clear, user-friendly loan disclosures must be presented upfront, including total loan cost, fees, and repayment terms.

Rollover Limits: Serial reborrowing and automatic rollovers are restricted unless new affordability checks are performed.

Withdrawal Caps: Lenders may not attempt to withdraw repayment from a borrower’s account after two failed attempts without renewed authorization.

Fintech lenders offering short-term or installment loans

Credit unions and community banks experimenting with new loan products

Servicers processing payments or renewals for third-party lenders

CFPB has already signaled enforcement readiness.

State-level regulations in California, Illinois, and others are layering on top.

The cost of non-compliance includes fines, license suspension, and public enforcement actions.

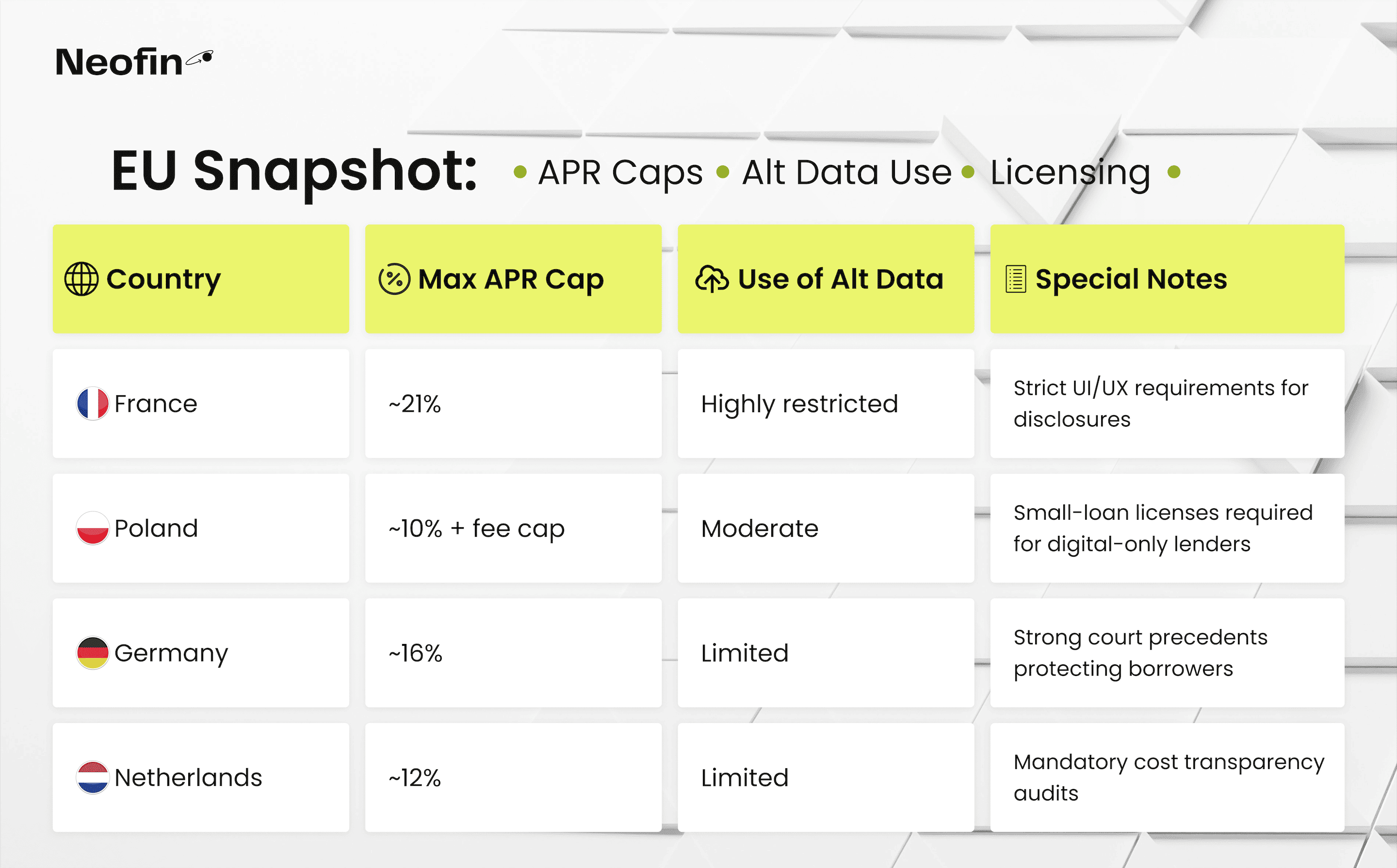

While Europe doesn’t have an exact equivalent to the SDLR, the Consumer Credit Directive 2 (CCD2) and national laws create a complex, yet stringent environment for lenders.

Adopted in 2023, CCD2 applies to all loans between €100 and €100,000, including BNPL and microloans. By November 2026, all EU member states must fully transpose CCD2 into national law.

Key Provisions:

Standardized Pre-Contractual Information (SECCI): Must be issued before a loan agreement is signed.

Stricter Affordability Assessments: Lenders must evaluate the borrower’s ability to repay based on documented income and expenses.

Ban on Dark Patterns: Marketing and interface design must not mislead or nudge consumers into credit products.

Withdrawal & Complaint Rights: Enhanced consumer protections post-loan issuance.

While U.S. fintechs often rely on behavioral or cashflow-based data, in Europe, use of alternative data for credit decisions is constrained by GDPR:

Data must be explicitly consented and clearly linked to the loan decision.

Profiling and automated decision-making are limited, requiring human review in most cases.

Violations can result in 4% of global revenue in fines.

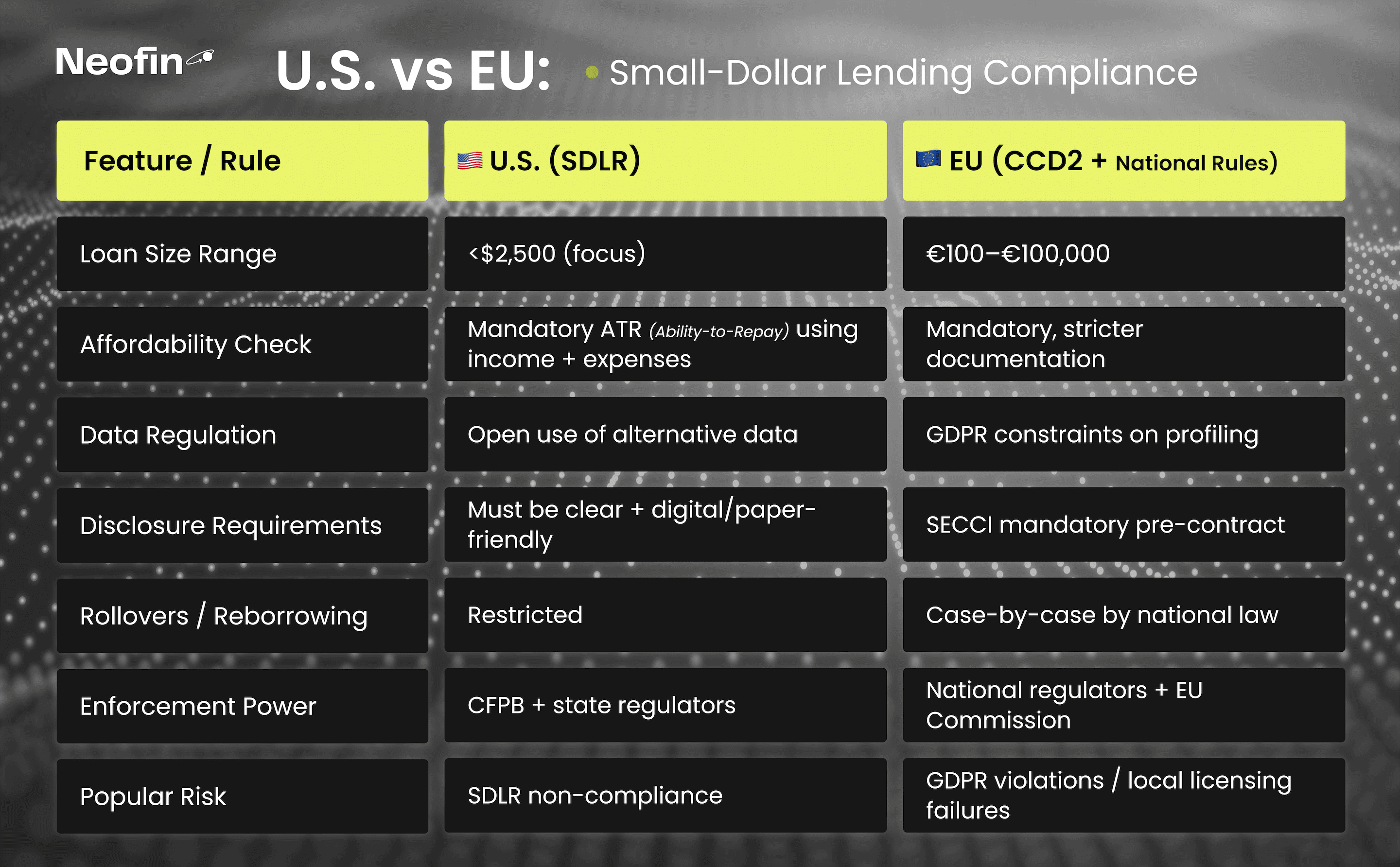

How U.S. and EU Small-Loan Rules Stack Up

Whether operating in New York or Warsaw, lenders face similar challenges: they must move fast, comply fully, and serve non-traditional borrowers without exposing themselves to legal risk.

Manual processes, inflexible legacy tools, or non-configurable lending engines simply don’t cut it anymore.

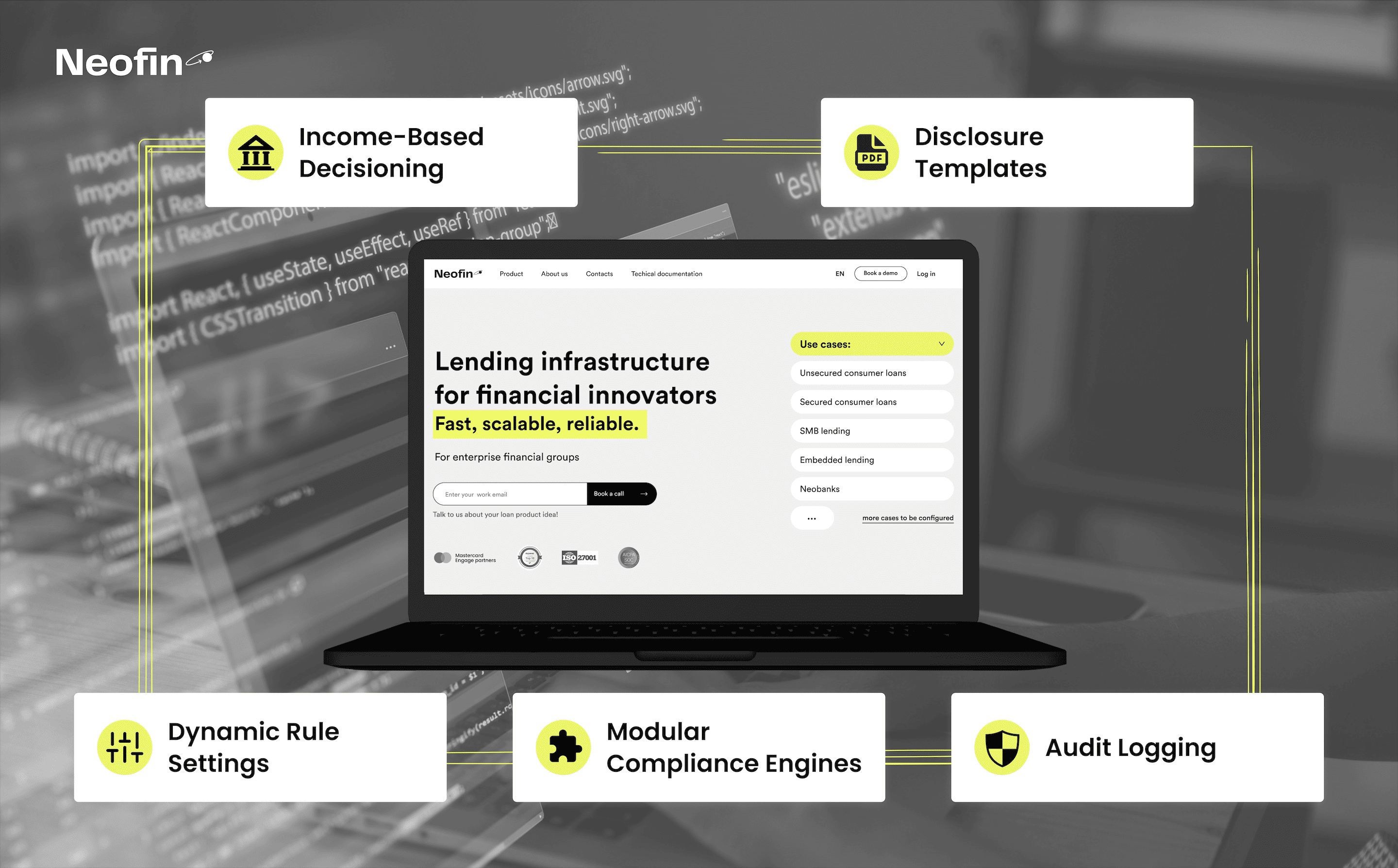

Neofin is a no-code lending automation platform built for modern compliance. We work with lenders across the U.S., EU, LATAM, and MENA regions, helping them launch faster, manage risk better, and stay ahead of regulation.

✅ Income-Based Decisioning Flows

Assess borrower income via open banking, payroll APIs, or gig platforms

Meet ATR requirements under SDLR and CCD2

✅ Configurable Disclosure Templates

Auto-generate SECCI or SDLR-compliant documents in multiple formats and languages

Map disclosure issuance to any trigger or channel (email, PDF, on-screen)

✅ Audit-Ready Logging

Every rule applied, every change made, and every document generated is logged and searchable

Stay audit-ready for state regulators, GDPR authorities, or CFPB examiners

✅ Dynamic Rule Settings

Set APR caps, fee structures, and repayment logic based on country, product, or risk level

Roll out regulatory changes without code or developer input

✅ Modular Compliance Engines

Integrate identity, credit scoring, and repayment checks

Swap in different providers per geography (e.g., Experian US vs. CRIF Poland)

Both SDLR and CCD2 show the same thing: small loans now come with big responsibilities. Whether you’re expanding into new markets or upgrading your compliance posture, automation isn’t a shortcut, it’s the only way to stay compliant at scale.

Neofin helps lenders adapt in weeks, not quarters. Ready to modernize your lending workflows? Let’s talk.