At Neofin, we often get a front-row seat to what’s coming in the lending industry. Since we frequently work with companies while they’re still building their loan products, we’re exposed to emerging concepts and innovations long before they hit the market. This gives us a unique advantage: not only do we follow lending trends — we see them forming in real time. Drawing on our research, hands-on experience, and insider perspective, we’ve compiled a list of the most important lending trends shaping 2025.

Lending in 2025 doesn’t look anything like it did five years ago. Traditional banks are facing competition from digital-native platforms, borrowers expect real-time approval and personalized offers, and regulators are keeping a close eye on compliance frameworks. But this is more than just a tech evolution. It’s a shift in philosophy.

The future of lending is about precision, speed, transparency, and inclusion. Financial institutions that recognize this and build infrastructure accordingly are not just surviving, they’re scaling faster, reducing risks, and creating better borrower experiences.

So what’s driving these changes? Below, we unpack the top trends in lending for 2025, offering fresh perspectives, sector-specific insights, and a critical look at how the industry is transforming.

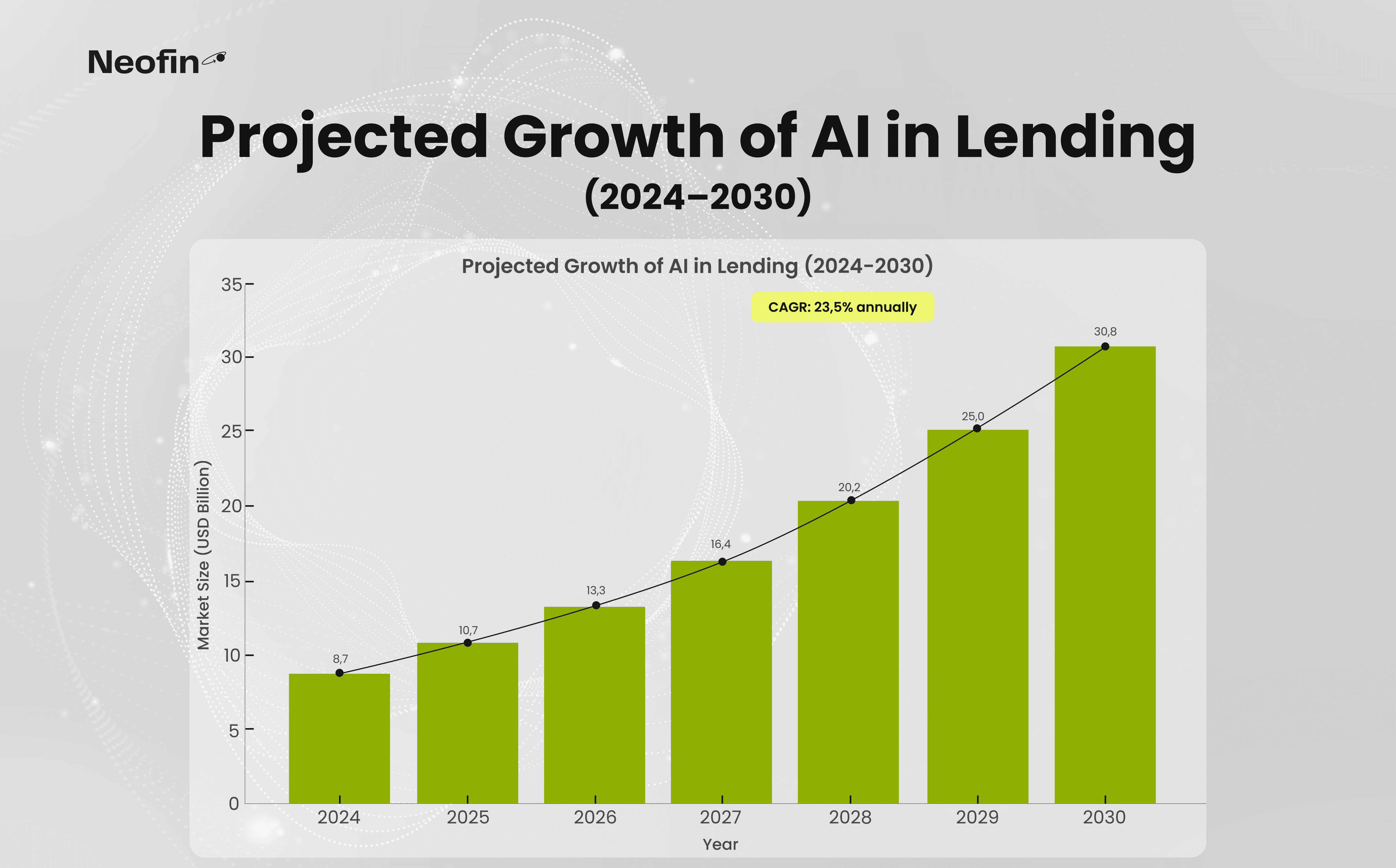

Gone are the days when credit decisions relied solely on static rules or FICO scores. In 2025, intelligent underwriting is powered by real-time behavioral data, transaction monitoring, and even social patterns.

Among the most influential consumer finance trends in 2025 is the shift toward personalized lending offers based on real-time behavioral insights.

Banks and fintechs are increasingly layering AI onto their credit risk engines. For example, some digital lenders now track micro-signals, like changes in income deposit patterns, to automatically adjust loan eligibility or suggest refinancing. This is especially effective in consumer lending, where risk shifts quickly and consumer lending trends demand adaptive, data-driven models.

Moreover, financial institutions are increasingly adopting AI-driven behavioral monitoring systems to enhance fraud detection and reduce default rates. For instance, Countingup, a UK-based fintech platform, implemented Fraud.net's AI-powered solution, resulting in an 88% reduction in fraud rates and an 82% decrease in monthly alerts within 90 days. Similarly, JP Morgan integrated AI-driven systems, achieving a 20% reduction in false positives, thereby improving customer experience and expediting the resolution of actual fraud cases. These examples demonstrate the tangible benefits of AI in enhancing fraud detection and operational efficiency within the lending sector.

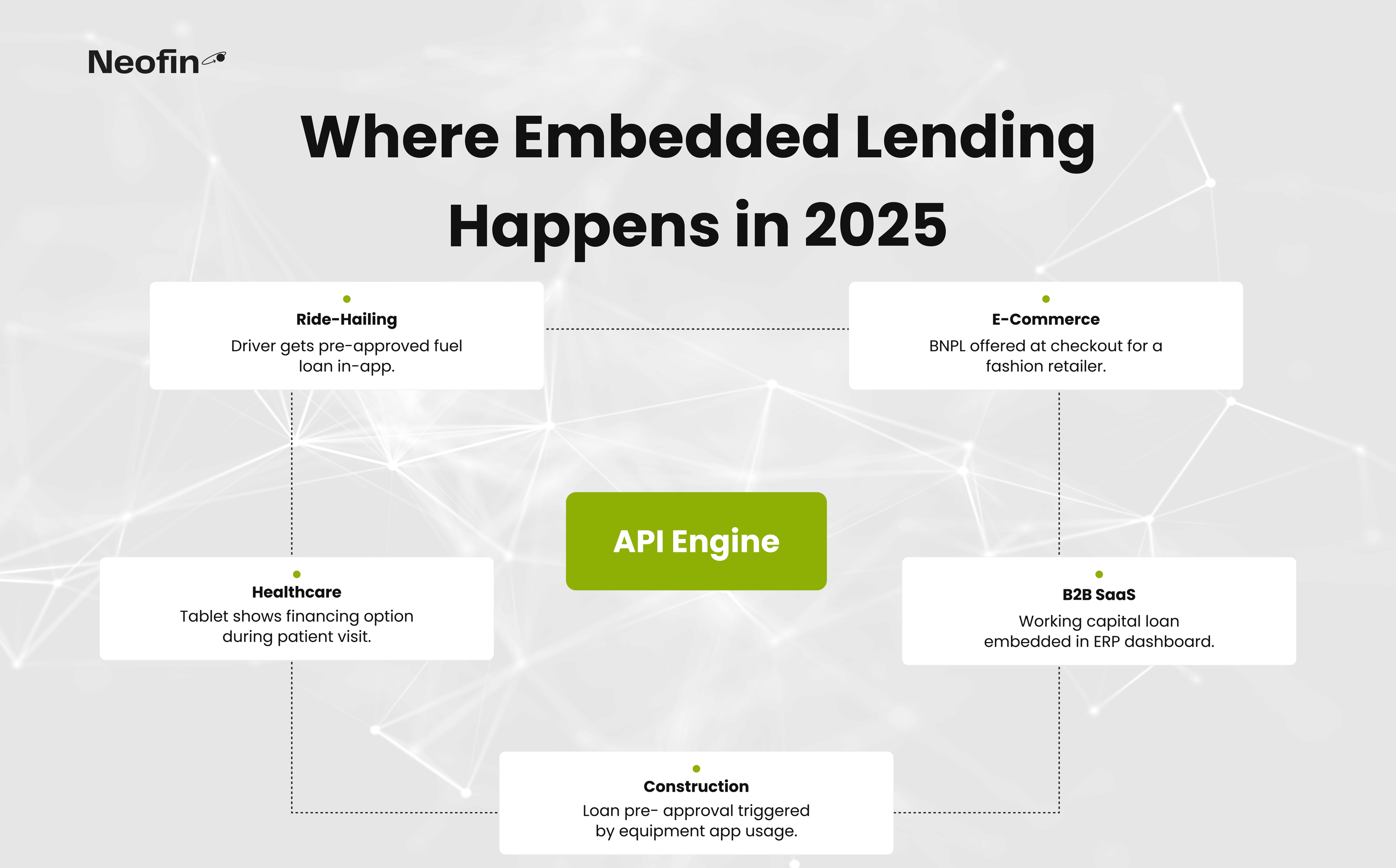

If you’ve bought a sofa online and been offered a monthly payment plan right at checkout, you’ve seen embedded lending in action.

In 2025, this model has gone far beyond e-commerce. Think: trade finance offered via ERP software, SMB credit inside accounting apps, or dental loans embedded in healthcare platforms.

Platforms like Square, Shopify, and Klarna have transformed what used to be a visit to a branch into a click within the customer journey. The best part is users don’t need to apply, they’re already prequalified based on existing behavioral and transaction data. Simplify loan processing from application to disbursement with our Loan Origination system.

For lenders, the challenge is now about infrastructure. Those who aren’t building API-first, white-labelable tech will simply be left out of the next wave of credit delivery.

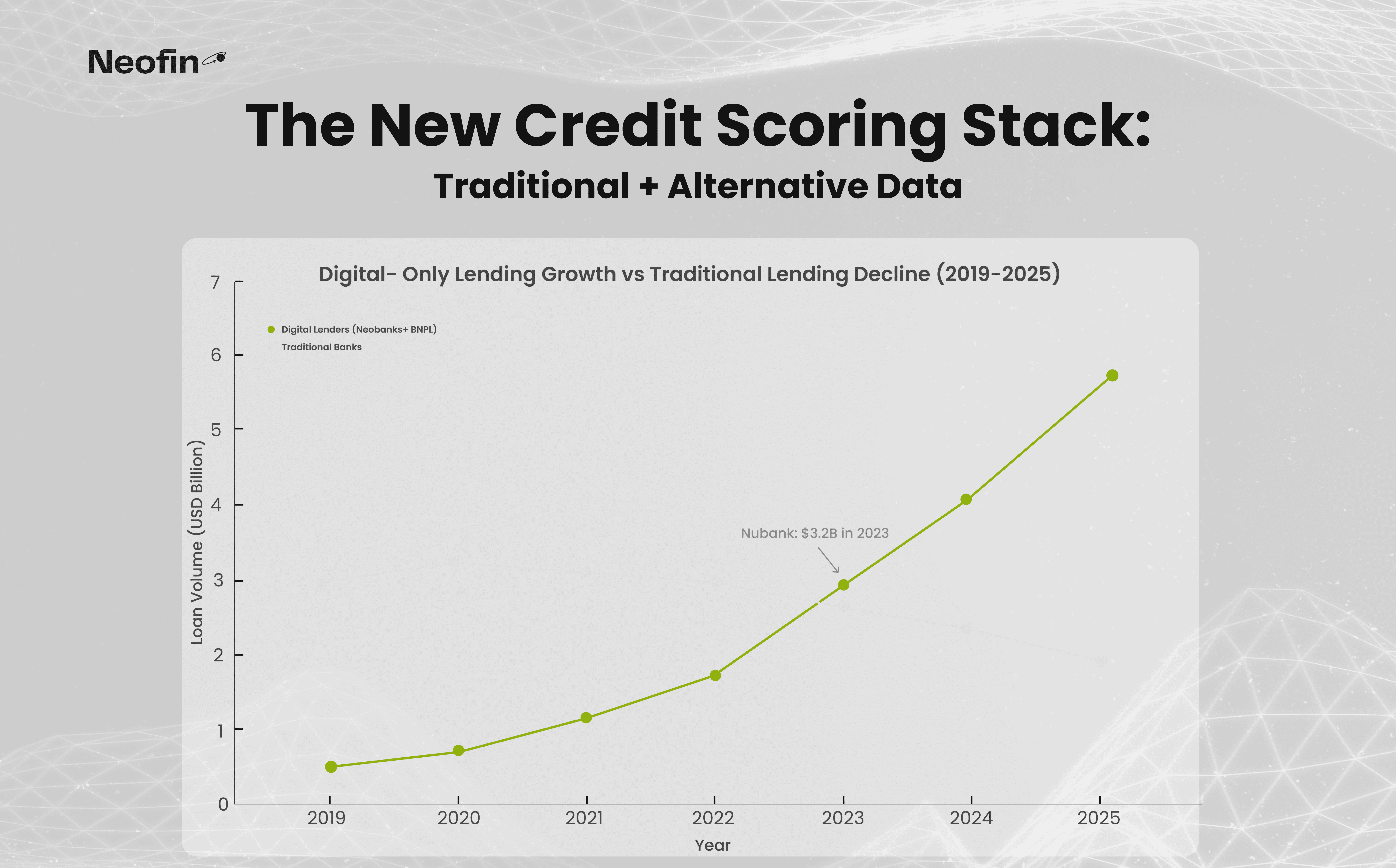

Credit scoring in 2025 is about context. While traditional bureaus still play a role, they no longer dominate the decision. Lenders now routinely combine bureau data with telco records, rent payments, digital wallet usage, and even ride-hailing behavior.

In parts of Africa and Southeast Asia, this is a basis of survival. Many users don’t have bank accounts, let alone a credit history. Fintech lenders there have built scoring models based entirely on mobile usage, airtime recharges, and peer lending history.

Even in mature markets, lenders using alternative data are outpacing competitors in acquiring younger, credit-thin customers, especially for BNPL and micro-credit products.

Alternative data is now one of the leading consumer finance trends, reshaping how financial inclusion is achieved across emerging and developed markets

On the surface, green loans support sustainable purchases: think solar panels, electric vehicles, or energy-efficient home upgrades. But in 2025, sustainability in lending is also about risk mitigation.

Regulators, especially in the EU and APAC, are pushing for environmental risk assessments in loan books. Some banks are even pricing interest rates based on ESG scores, rewarding borrowers who demonstrate lower carbon footprints.

Case in point: leading mortgage providers in the UK, such as Ecology Building Society, Virgin Money’s “Greener Mortgages” recently introduced a carbon discount or rate perks for sustainable housing. Borrowers whose homes met specific environmental standards qualified for a 0.25% interest rate cut. The uptake: over 40% of applicants switched to eco-retrofitted properties to qualify.

For forward-thinking lenders, green financing is fast becoming both a compliance lever and a competitive differentiator.

PSD2 may have started in Europe, but by 2025, open banking frameworks have gone global. In countries like Brazil, India, and Australia, borrowers can now share account-level financial data directly with lenders in real time.

This has flipped the credit underwriting process. Instead of relying on what someone borrowed or repaid years ago, lenders now analyze income volatility, recurring bills, and real-time spending to make decisions.

Take the case of neobanks in Brazil, like Nubank. By using open banking APIs to access gig workers' real-time income, they significantly increased approval rates for short-term credit (according to various sources, approval increases reached 60% at times), without increasing default rates.

The power of open banking is about better data - AND building trust. Borrowers can now prove their affordability without complex paperwork, creating faster, more transparent lending experiences.

Static fraud detection is outdated. In 2025, lenders are using dynamic behavioral analytics to stop threats before they escalate.

Imagine a customer applying for a loan from a new device in an unusual location. In older systems, that wouldn’t trigger an alert unless it breached a rule. In modern ones, it’s flagged instantly, especially if coupled with unusual spending or repeated high-value transactions.

Using biometric anomaly detection (via typing speed and mouse movement) to flag bots during loan applications is getting popular among the US lenders, some reporting up to 70% drop in automated fraud attempts. As lending APIs open up more touchpoints, fraud prevention must be embedded, not layered on.

Traditional banks are rapidly losing market share to digital-only lending platforms that offer faster approvals, user-centric design, and lower operational costs.

According to Statista, digital lenders have experienced exponential growth globally. Take Brazil, for instance: between 2019 and 2023, Nubank expanded its customer loan portfolio from $58 million to over $3.2 billion. That 55x leap wasn’t driven by legacy infrastructure, it came from mobile-first experiences, embedded credit models, and frictionless user flows.

This isn’t just a Nubank story. BNPL giants like Klarna and Afterpay have also become major players in short-term lending, delivering instant point-of-sale financing in e-commerce environments. As BNPL adoption rises globally, traditional personal loans and credit cards are being quietly displaced.

But the biggest shift here is that many of these players don’t even consider themselves “lenders” in the traditional sense. They are product-led platforms embedding credit at the edge, right where users make spending decisions.

AML, KYC, data residency, and audit trails used to be back-office headaches. But in 2025, compliance has become a product feature, one that borrowers and regulators alike expect.

Lenders are now building configurable compliance engines into their core systems. Think: instant sanctions screening, automated AML workflows, and smart alerting for high-risk geographies.

And this isn’t just for the big players. At Neofin, we've recently implemented real-time compliance monitoring through a no-code rule builder for a mid-sized BNPL provider. . Not only did this reduce manual reviews by 40%, but it also helped them enter two new markets without adding headcount.

In short, compliance is now a core part of scaling lending operations.

Consumers aren’t just borrowing more, they’re borrowing smarter. The old “one loan fits all” model is being replaced by loans that are smaller, shorter, and more contextual.

Popular formats in 2025:

Medical microloans disbursed via hospital apps

Education loans triggered by course enrollment

Instant credit for B2B SaaS subscriptions

Pay-per-use credit lines for gig workers

This movement is about building products that match real-world cash flows. The top 5 lending companies globally are already leveraging these micro-loan formats to personalize lending.

For lenders, aligning operations with the top fintech trends means investing in modular, scalable platforms that support innovation at the edge.

Lending in 2025 is not just about speed or scale. It’s about intelligence, integration, and inclusion. The platforms leading this evolution aren’t necessarily the biggest, they’re the most adaptable.

They’re using AI to make better decisions, APIs to extend reach, and real-time data to personalize products. They’re not reacting to regulation, they’re building for it. And they’re not guessing about customers, they’re listening to them, one signal at a time.

Whether you’re a fintech founder, a digital lender, or an established bank executive, the message is clear: the future of lending belongs to those who are building it.